Market Sentiment Survey 2019

There are increasing rumblings on the street that the Barbados property market is improving.

This is against the background of a passing grade from the IMF in their December 2019 review and a number of high profile market transactions. These include: the Marriott’s acquisition of the Elegant Hotels group, the announced sales of the former Four Seasons site at Paradise and the Apes Hill Development, progress on the expanded Hyatt Ziva project, the acquisition and proposed redevelopment of various properties along the Careenage, Carlisle Bay and other projects in the pipeline.

All very encouraging for an economy with the stated goal of a private sector led recovery, and likely fuelling some perception in the market that the market is beginning to recover. But how has the broader real estate market actually been performing over the recent 12-month period?

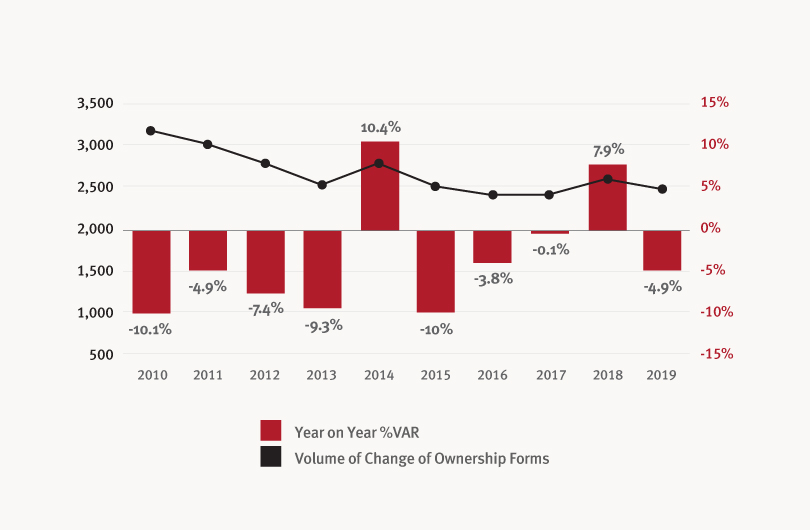

Market Sales Volume

Well the numbers are in for 2019 and it seems the market had a nominal decline of 5% in transaction volume over the 2018 period. See Figure 1. This is not to suggest that market values declined in 2019, rather that the overall volume of sales which occurred in the market declined by 5%. Perhaps this is unsurprising given the economy is reported to have contracted by 0.1% over the same period which was in line with Central Bank expectations. Whereas there were various adjustments implemented in the 2019 budget, including a sweeping overhaul of the corporate and personal tax rates, the increase in Land Tax rates has likely not encouraged the market in the short term.

Market Sentiment

Whereas overall market volume is not ‘yet’ showing signs of growth, there is a strong sense that confidence is on the rise and more specifically since elections in 2018. Market sentiment continues to be a reliable leading indicator of activity and we thought this an opportune time to survey the market to see what trajectory sentiment is on and to ask clients to weigh in on a few issues. In December 2019, approximately 18 months post the election of the new government, we conducted a survey of both local and foreign clients from a broad cross-section of the market. As a reference point, we last conducted a market sentiment survey in December 2017 just prior to elections. We started with a few macro questions which are illustrated over the next 3 pages, including a comparison of the responses received in both 2019 and 2017.

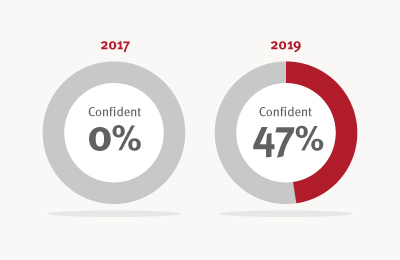

Confidence In The Barbados Economy

Are you confident the economy is on the right track?

Perhaps this is where the most sweeping change in sentiment was observed from zero respondents expressing confidence in the state of the economy in 2017, to 47% in 2019. This would appear to substantiate the feedback we are getting on the ground daily from clients, where there is a distinct sense that the various fiscal adjustments will begin to pay dividends and the market is beginning to move.

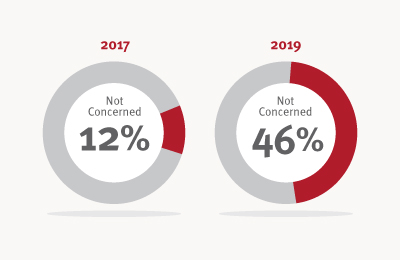

Confidence In The Barbados Dollar

What is your level of concern about a devaluation of the Barbados dollar?

Related to that would be the change in views around the strength of the Barbados dollar which has also substantially improved. Together these likely reflect clients’ confidence around the leadership, and the progress of the Barbados Economic Recovery and Transformation (BERT) programme to date.

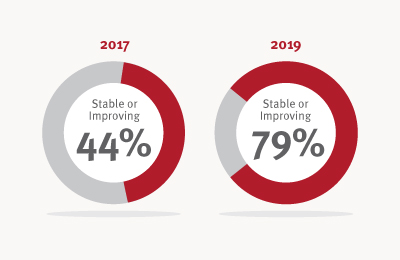

View Of The Current Real Estate Market

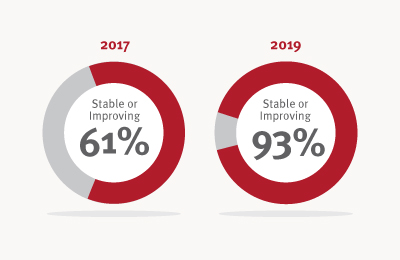

What is your opinion of the current market – is it declining, stable or improving?

Similarly, there was an 80% increase in those respondents with a favourable view of the current market in 2019 when compared to 2017.

Outlook For The Next 3 Years

What is your outlook for the market in 3 years?

There was also a resoundingly confident view on the three-year outlook for the market.

Taken together these four questions paint a markedly different picture of attitudes around the Barbados property market since 2017. The question will be, when does attitude translate to action and when will we begin to see the needle move.

Our own (the Terra Group) sales numbers in Q3/Q4 2019 reflect a notable increase in pipeline sales (sales instructed but not yet completed) and that trend has continued into January 2020. Given the usual 3-6 month period to complete a sale, it is quite possible the broader market began to improve in the latter part of 2019 and those sales will be reflected in the 2020 numbers when they are eventually complete.

Additional Survey Questions

Following are a number of topical subjects we asked clients to weigh in on.

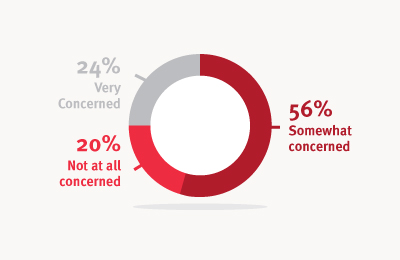

1. Concern About Brexit

What is your level of concern about the impact of Brexit on the market?

The responses indicate some level of concern about the possible impact of Brexit on the broader Barbados economy. Whereas the survey pre-dated the UK elections in mid-December, it is likely that more certainty around the process may have a positive impact on sales in the foreign luxury market.

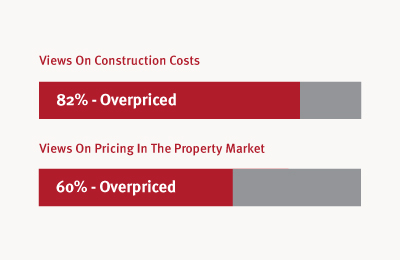

2. Views On Construction Costs

What are your views on construction costs?

3. Views On Pricing In The Property Market

What are your views on the pricing of properties listed on the market for sale?

Respondents taking the view that the market continues to reflect overpricing across the board whether vacant land or improved properties increased from 54% in 2017.

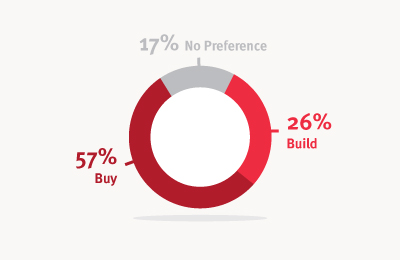

4. Buy vs Build

Which is preferred – building or buying a home?

As is typical with bottom cycle market conditions, market value is generally less than replacement cost. All things being equal, this points to buying as the better option until such time as there is a reduction in construction costs, or the market begins to grow. Most respondents agreed with this, which correlates with the view that construction costs in the market are still largely inflated.

5. Beachfront Development –

How high is too high?

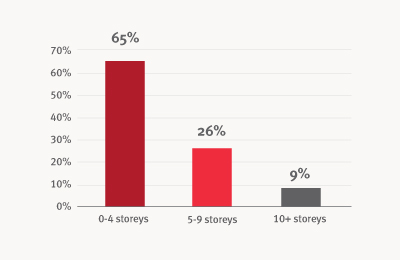

What should be the maximum height permitted for beachfront development?

Building heights continue to be a hot-button issue with over 90% of respondents indicating a preference for less than 10 storeys. The proposed redevelopment of the Blue Horizon hotel at Accra and the construction of a new Hyatt Ziva on Carlisle Bay have once again brought the issue to the forefront. Notably the redevelopment vision articulated in the Carlisle Bay Master Plan includes a number of development concepts with outline approvals for mid and high-rise towers up to 25 storeys.

6. Industry Assessment

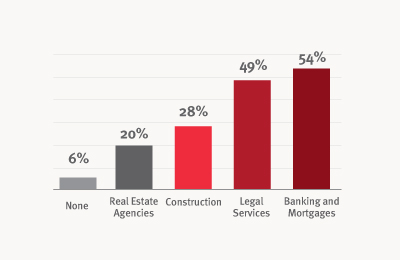

Which of the following segments of the market / industry do you think is most in need of an overhaul?

Additional Comments

We also asked respondents to offer any additional comments on the market in general. Highlights from the answers include a clear expectation that improvements in the areas of business facilitation, the planning and legal processes and the overall

enabling environment are absolutely necessary to ensure any level of sustained confidence and growth. Perhaps unsurprisingly, the comments also reflected a sense of a wait-and-see approach on whether all of the larger projects announced will actually get underway.

Summary

It would certainly seem that the market is on a better footing now more than any time in the recent decade, with both the IMF and the Central Bank forecasting some measure of growth in 2020, savings levels and reserves at recent highs, and now with market sentiment seemingly at a high. The reality is after a decade of tough trading conditions, the market is ready for a resurgence.

The announcement of the new Planning and Development Act which is replacing the old Town & Country Planning Act has been received with much anticipation. It is said to “emphasise speed and predictability” in the approvals process including a number of additional enhancements and an adjustment to previous height restrictions. The Carlisle Bay Master Plan articulates a grand vision for the development and transformation of seven strategic areas within the greater Carlisle Bay and Bridgetown areas.

Together these include approximately 12 new hotel sites and other development concepts with a site-specific approach where outline approvals have been put in place. There is also a stated commitment to overhaul the fiscal incentives regime to facilitate investment with a preference for those projects which bring in foreign exchange for development. Certainly these are steps in the right direction towards encouraging development and communicating a message that Barbados is open for business.