Land Tax Changes

Buying land is an age-old investment strategy. Some purchase land to build a dream home or to develop the property in order to enhance its resale value. Others buy land to grow their investment portfolio and sit on the asset for years before ideally selling at a higher price tag. No matter the reasons behind the purchase, owning the right piece of land can offer decent long-term gains.

Land is usually a very low maintenance investment. Apart from financing loans, and keeping the land to health code, the only major expense for owners to consider is taxes. While purchasing land, an experienced realtor can help guide owners through all tax obligations which are typically factored into the decision. Challenges can arise when governments implement changes in the land tax structure whether thresholds or rates, and owners are faced with unanticipated costs and new considerations to make about their investment.

Dealing with the land tax rise in Barbados

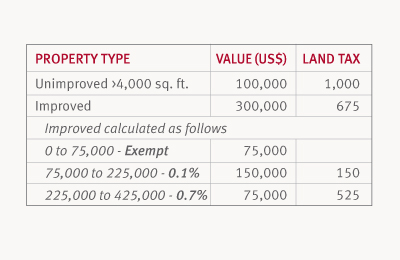

Rising land tax is something that we’ve recently seen in Barbados. Outlined in the 2019 budget, Prime Minister Mia Mottley proposed an increase in the tax rates and applicable bands for residential property. Tax rates on vacant lots exceeding 4,000 sq. ft. saw a 25% increase, rising from 0.8% to 1%. The goal behind this was predominantly to discourage the holding of vacant lots and to encourage the development of the lots into housing solutions.

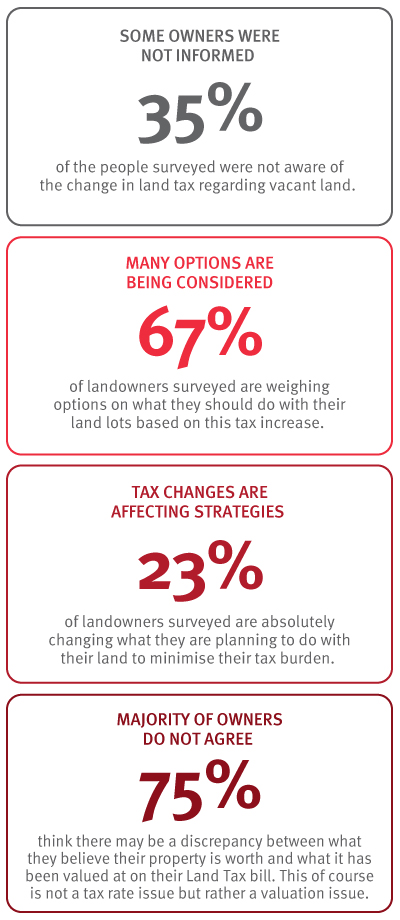

So, how do owners feel when confronted with this unforeseen land tax increase? How does this change an owner’s strategy, especially if they’re in the earlier to mid-range lifecycle of the investment? To accurately answer these questions, a poll was conducted among Terra’s network of clients who purchased land in Barbados within the last five years.

Three ways to tackle increasing land tax in Barbados

While most owners may not like the tax rate increase, not all will be disturbed by it. In fact, the poll suggested that 1/3 of owners will enact no changes to their plans with their land. Especially for those who had short-term plans to build on the land, this makes sense. However, for those who view this 25% as a significant holding cost increase which will ultimately erode any returns, here are a few considerations:

1. Develop the land – Since the reason behind this tax increase was to incentivise landowners to develop their plots, owners who maximise their investment by building property on their land will see not only a reduced tax bill as demostrated in the example below but can also potentially generate income from the improvement.

Currently, there are limited investment options for local Barbadians. Barbados does not have an active stock market and there is no longer any tax incentive for adding to mutual funds; this makes improving the land a viable option providing the owner has sufficient access to additional capital.

2. Divest and sell the land – Faced with the increased holding cost with no matching income some might consider divesting assets and selling the land now. In this case, it’s wise to consult an experienced realtor or valuer who can provide a market price based on an opinion of value and any other factors that should be considered before listing the property. The realtor could also discuss other options which may be more advantageous to the owner. Realising the cash from the land sale and reinvesting in an improved property with an income stream is an attractive option.

3. Dispute the land value – Fifteen years ago land tax values were often found to be less than the market value. However, after a sustained decline in market value over the last 10 years, we are now more likely to see land tax values in excess of market value, giving rise to an opportunity to object to the value in the triennial cycle. It’s no surprise then that 75% think there may be a discrepancy between the owners’ opinion and that reflected on their Land Tax bill. The most surprising element, however, is that 64% of landowners have no idea what to do about it. 2020/21 is a valuation year providing a window of opportunity for owners to file for objections for taxes demanded. The full process is outlined below.

What’s involved in disputing land value?

Every three years, the Barbados Revenue Authority (BRA) carries out a valuation process to update the site/improved values of land and properties in Barbados. Once the analysis is complete and the final value is determined, the tax assessment is circulated to property owners as part of the tax demand process. In previous cycles a valuation was issued separate to the tax demand but this practice was ended in 2017. Now the value on the bill is the assessment.

Taxpayers are required to pay the tax due by March 31 of the following year or risk incurring penalties and interest. An owner wishing to file an objection must do so in writing, to the Revenue Commissioner, using the Notice of Objection to Valuation Form. This form must be filed within 21 days of the tax assessment issue date.

Owners may file an objection on the following grounds:

• the values assessed are too high or too low

• the lands which should be included in one valuation have been valued separately

• the lands which should be valued separately have been

• included in one valuation

• the person named in the notice is not the owner of the land

If the objection is to the assessed value, the opinion of value is best supported by a Valuation Report from a competent Valuer which includes evidence of comparable market sales.

This year is a revaluation year which means owners should see the updated values reflected in BRA assessments received after March 31, 2020.

Making informed decisions protects land investments

Buying land in Barbados has always been a straightforward and low-maintenance investment. You buy it and you forget about it. And while that’s still true, recent changes in land tax are disrupting the market, causing owners to re-think their strategies.

While there are many options available to owners, it can be difficult to make wise decisions without the right information. Working with a knowledgeable and proven realtor can help. Armed with your own research, an experienced agent can be your sounding board and work with you to ensure you achieve your goals and protect the profitability of your investments.