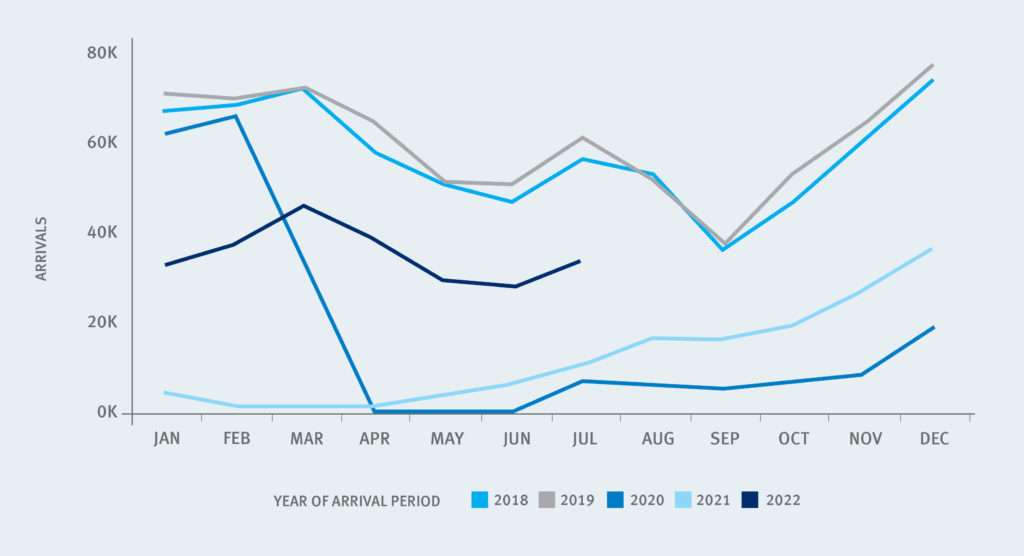

The resilience in bookings for villas and vacation rentals through the pandemic is unquestionable. In Barbados, tourism has traditionally contributed 40% of gross domestic product for the island both directly and indirectly. While tourist arrivals currently sit at less than 60% of 2019 (pre-pandemic) levels, occupancy rates in villas and vacation rentals have matched or exceeded 2019 levels. The factors that likely influenced this difference vis a vis the hotel sector have been the higher average spend, the perceived health and safety levels, and of course the Welcome Stamp initiative.

This trend has continued into the “pandemic recovery period” with advance bookings within the villa sector continuing strong, reflected in the first six months of 2022 showing volumes 25% ahead of pre-pandemic levels.

While the popularity of villas has improved in recent years, their presence in the market isn’t new. The earliest second home developments were built in Barbados in the 1960s with Sandy Lane and Sunset Crest, followed later in the early 1990s with Royal Westmoreland and then Port St Charles amongst others. With the second home market growing significantly in the past 50 years, inventory has risen significantly. In the last published study, completed in 2009 with data supplied by the industry players, the market identified 814 units (loosely called villas) actively being rented, representing approximately 2300 available bedrooms. This was before AirBnB, VRBO and other Online Travel Agents (OTAs) had gained popularity on the island and added to the available stock.

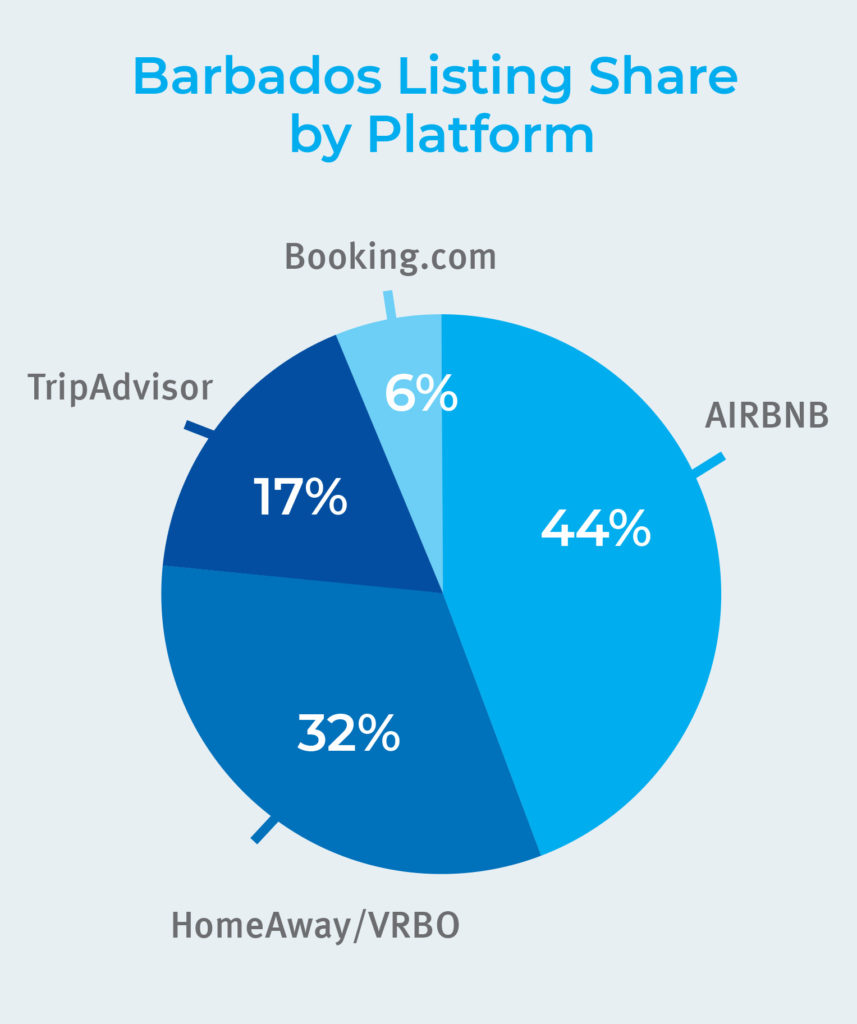

In Barbados the villa market is poorly understood and not really studied at all, but the economic impact is significant. Recent metrics show that Barbados now has over 9,000 active listings on the online channels, representing approximately 6,000 properties and 13,000 bedrooms, in addition to hundreds more villas not currently listed on these channels and managed by professional management companies. It is definite that some properties are duplicated over multiple platforms making it difficult to draw a true picture of the stock. Based on feedback from Tour Operators worldwide, Barbados has some of the best villa product available in not only the Caribbean, but worldwide. This, coupled with Barbados’ excellent infrastructure, abundance of attractions and experiences to explore, makes us well placed to promote our product offering and remain one of the regional leaders in the segment.

The work done by our Prime Minister The Hon Mia Mottley in raising the profile of Barbados cannot be underestimated. In addition, the brand exposure from superstar Rihanna and the continued presence in the media of sports stars such as Zane Maloney on the F1 circuit keep the Barbados brand top of mind and associate it with best-in-class performance.

The other segment of the villa market that is often not considered is owner use homes. We estimate that in addition to the 814 units that were actively promoted for rental in 2009 via property management companies, at least another 400 are not rented and kept as second homes for exclusive private use. These same homeowners are contributing to our economy by employing staff, funding upkeep through foreign exchange, Land Tax, National Insurance, and spending foreign currency on island during their visits as tourists. Most of these properties maintain year round staff although unoccupied.

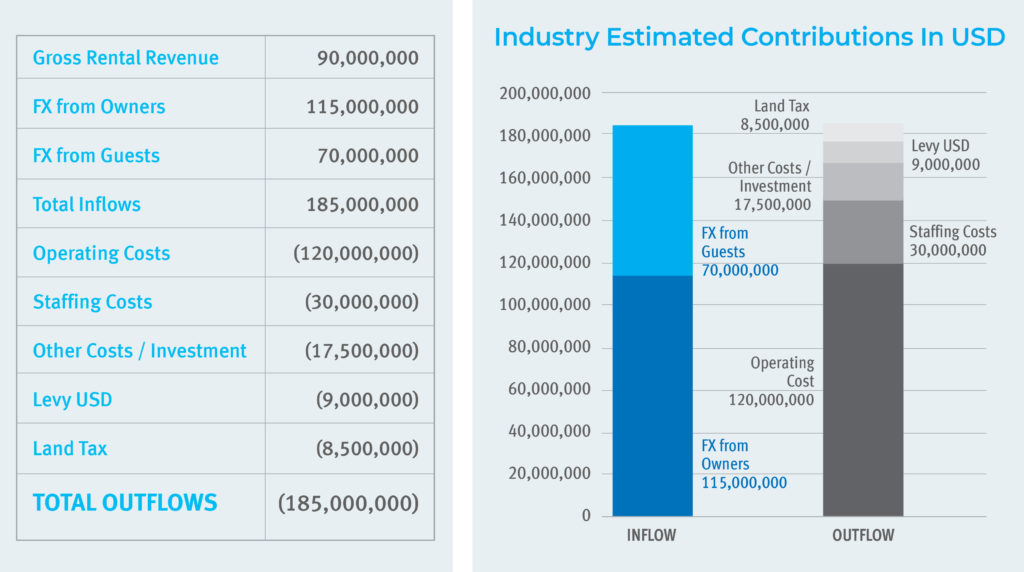

To demonstrate the impact of our market on the economy in Barbados we looked at data from our own portfolio of 260 properties under management, representing 848 bedrooms including 424 in short term rental. We then estimated the total for the industry based on the confirmed 2009 figures and adding a conservative additional 50% to account for units only utilized for foreign owners, but not available for rent. Here are some key findings that just might surprise you for a sample of only 1220 properties, which we already know is an under representation of the market. It is important to note that these numbers are our best estimate and not a compilation of actual figures. Furthermore, note that there is less than 1% annual earnings for these properties from local revenue meaning that 99% of the expenses are paid from foreign exchange earned or remitted by the owners to cover the short fall.

Land Tax:

Just like any property owner, villas are subject to land tax as well. Villa rebates exist to provide a 25% rebate on land tax for any villas available for rental for at least 9 months of the year, valued over US$262,500 that have a minimum of 3 bedrooms and employ a minimum of 3 staff. Notwithstanding this, land tax payments range from as little as US$100 per annum up to the annual cap of US$50,000 per villa per annum.

Operating Costs:

This represents all running costs for operating the property inclusive of maintenance, utilities, etc, but excluding staff costs which are shown separately above.

Staffing:

Job opportunities exist for housekeepers, chefs, cooks, gardeners, security guards, general workers, butlers, and house managers. On average each villa employs almost 2 full time staff members. In larger luxury villas, many houses employ over 15 staff when a house is occupied and in some cases over 20 staff to operate a 10-bedroom property. Based on this, we estimate the industry employs between 2,000 to 3,000 persons directly in addition to the countless tradesmen and service providers supported by the industry. Based on evidence collected from our HR division the average wage / salary for employees in the villa sector are on average 30% higher than the hotel sector. It is also notable that during the pandemic staff directly employed in the owner-occupied segment of the villa sector saw few layoffs and redundancy as owners looked after their loyal staff.

Foreign Exchange:

While some villas do achieve a rental yield, the vast majority rent in order to earn a contribution to running costs, keep staff busy, and to keep the home operating in the absence of the owner. The reality is that very few cover their full costs of operation from rental income, meaning that all the FX earned stays on island. This is a unique feature of the villa sector with at least 99% of all expenses paid via FX gained through rentals or owner remittances. Repatriation of the FX to overseas owners only happens on the sale of the property and in almost every case this is matched with the equivalent inflow from the new owner to complete the purchase. What this means is that Foreign Exchange invested in the villa market remains in Barbados permanently.

Tourism Levy:

Under the Tourism Levy Act, all tourism accommodation is required to correct a Tourism Levy from guests. In the case of villas, the 10% Shared Economy Levy applies. Based on estimates of revenue a total of US$9 million is collected for villas annually. It should also be noted that many of the individual small operators of villas on OTAs are not presently registered and charging levy. The potential for increased tax revenues with better management and collection of taxes at source can improve the contribution of the sector overall and this move is supported by Vacation Rental Management Companies to level the playing field.

Summary:

In conclusion, the villa sector is not well understood by anyone outside of the direct industry players. The charitable efforts alone by the villa owners are in the tens of millions per year. The villa owners love Barbados, they invest directly in property ownership and then they invest every year in paying the expenses as detailed above. The bottom line is that the foreign exchange earned from this sector remains in Barbados and is a permanent annuity unparalleled by any other sector. Once you build a property in Barbados you can’t migrate it to another jurisdiction. It is a permanent part of our tourism industry.

The opportunities for Barbadians to work in the villas are unparalleled and the conditions of work both physical and financial are unmatched in the broader tourism market. The BTMI is embarking on an updated study of the sector which is long overdue. We are anxious to see the final conclusions that we believe will exceed even our projections for the real value of this segment to Brand Barbados, our tax base, and our foreign exchange earnings.