Photovoltaic in Barbados – On the Rise

As a country with minimal oil or gas resources and no refinery infrastructure, Barbados is largely dependant on fossil fuel imports for its energy needs. This reliance on fossil fuels and vulnerability to the fluctuation of global oil prices directly affects the cost of electricity production. In addition to the cost of direct consumption, the general economy is further affected by the knock-on effect to all products and services produced on the island.

In order to minimise the impact of this expense, the Government of Barbados (GoB) in the Barbados National Energy Policy (BNEP) 2019 – 2030 has outlined a plan for transitioning the country from a fossil fuel dependant nation to one that is 100% renewable energy-based and carbon neutral by the year 2030. In the transition, the cost to consumers is anticipated to be lesser than the cost of maintaining fossil fuels for electricity generation. The savings over the proposed timeframe of the BNEP transition is projected to be US $26m, based on the avoided cost of fuel required for electricity generation. While this estimate takes into account changes to some of the existing grid infrastructure, it does not consider the cost to the Barbados Light & Power (BL&P) of replacing most of its existing aged fossil-fuel driven plant equipment with similar new equipment, which has recently been assessed as necessary.

In order to meet this renewable energy goal there has been a push to have greener infrastructure by encouraging sustainable new build designs and retrofitting of older buildings. For the latter, though limited by their initial design, energy audits have revealed that energy consumption reductions can be realised through more efficient lighting as well as Heating, Ventilation and Air Conditioning (HVAC) equipment. It is estimated that the simple replacement of older bulbs with LED bulbs can reduce electricity requirements for lighting by 50 – 90% depending on property type and use. In addition, the increased use of Photovoltaic (PV) systems has also occurred to help reduce the operational cost of the building.

The BL&P started a pilot project in 2010 which allowed the public to generate their own electricity using a grid-tied PV system. The Renewable Energy Rider (RER) contract which is regulated by the Fair Trading Commission (FTC) gives owners two options to sell electricity back into the grid:

Buy all/sell all –

Owners are billed by BL&P at the normal electricity rate for all electricity consumption regardless of source and then will receive a credit on the bill for all electricity generated from the PV system.

Sale of excess –

Only available for systems under 2kW, owners are billed by BL&P for electricity received from the grid. A credit is then issued for any excess electricity generated

from the PV system that is not used but exported to the grid.

Participants receive a credit as calculated by a Fuel Adjustment Clause Adjustment approved by the FTC which was traditionally adjusted periodically.

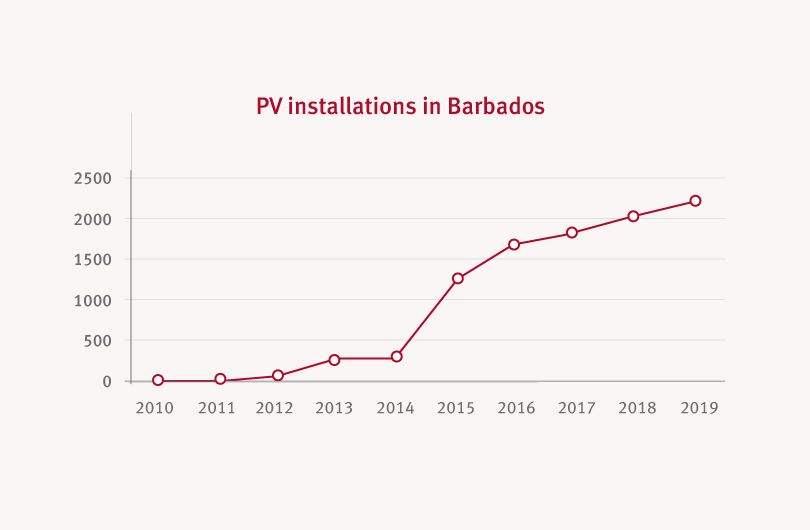

In 2013, the GoB passed the Electric Light & Power Act, which introduced the requirement of licensing for PV grid-tied installations, and the legal framework for payment of its production by third party producers. As a result, along with decreasing costs in technology, there has been a notable increase in PV installations since 2013, as illustrated in Figure 1.

Currently the installation costs for residential systems in Barbados can start around US $5,000 and increase subject to the system and equipment installed. The proposed payback period for these systems is also estimated to be 5 -7 years.

An alternative option available to the public is an off-grid system whereby solar energy produced by the PV panels can be stored in batteries instead of being sold back into the grid. The premise behind this system is that batteries are charged by the system in the day so that it can be utilised after sunset hence reducing the electricity consumption required from the BL&P. The market response to this set-up has currently been reported to be less favourable when compared to grid-tied systems as there is additional expenditure required for the batteries.

PV installations should lead to reduced expenses and an increase in profitability for owners.

The number of property sales with PV installations is minimal and it appears that the motivation for these installations is primarily to reduce expenses, not immediate sale purposes. In the absence of a significant volume of transactions with these systems it is difficult to determine the value premium attributed to this investment. In the United States the study Understanding the Solar Home Price Premium: Electricity Generation and Green Social Status was conducted by The National Bureau of Economic Research in California, which has the most PV systems installed on residential properties per state. A large sample size of homes in the San Diego and Sacramento areas was used. The findings indicated that there was a 3 to 4% premium on homes with solar panels. While this 2011 study did not indicate a positive return from a discounted present-value calculation, it was widely acknowledged that this return would be more positive as manufacturing costs have decreased and efficiency of cells increased, over time. As such, while this market is still in its infancy, we anticipate that a value premium for similar PV properties in Barbados will also be achieved in years to come.

For commercial properties, the motivation behind PV installations is viewed differently. Due to their size, and hours of business these properties will incur high electricity expenditure. PV installations should lead to reduced expenses and an increase in profitability for owners. Additionally, landlords can offer more competitive rental rates than buildings without PV installed, as well as attract tenants who value green business.

The most noticeable change to the real estate landscape has been seen in the installations of PV on warehouses. These properties, which have large roof surfaces for multiple PV panels, can facilitate revenue generation by selling any excess electricity produced back to the grid. This ability has not gone unnoticed as investors have approached landlords to lease roof space for PV installations. These Independent Power Producers (IPPs) can realise a desirable return on investment. This arrangement is also beneficial for the landlord as it creates a revenue stream that requires zero investment from their existing infrastructure.

Following a recent decision by the FTC in September 2019 which determined that the BL&P credit rates can now be locked in for a 20-year period, it is anticipated that the demand for PV systems will increase. This development provides a more desirable customer environment that can potentially guarantee the return on such investments. Similarly, the FTC’s decision has reduced the risk in such investments, leading to more favourable financing terms becoming available. It is therefore expected that the current trajectory of the installations will continue.

Overall, while this type of investment makes economic sense over the long-term use of a property it is also in keeping with the local and global movement towards a more sustainable green economy.