Broker’s Opinion of Price or Market Value Reports?

If you are considering the sale or rental of your property then getting an opinion of its current market value is key. But you may be unsure whether to speak first with a Valuer, or your trusted Real Estate Agent. Each professional provides a different service so it’s important that you ask the right questions, to ensure that what they provide best suits your needs.

Typically, a real estate agent estimates your property’s value before it is listed for sale or rent, based on recent transactions for similar properties. This estimate is used to recommend an achievable sale price for your property. This is a Broker’s opinion of price and is mainly for the benefit of the seller / landlord as the agent wants to help set the most realistic listing price possible.

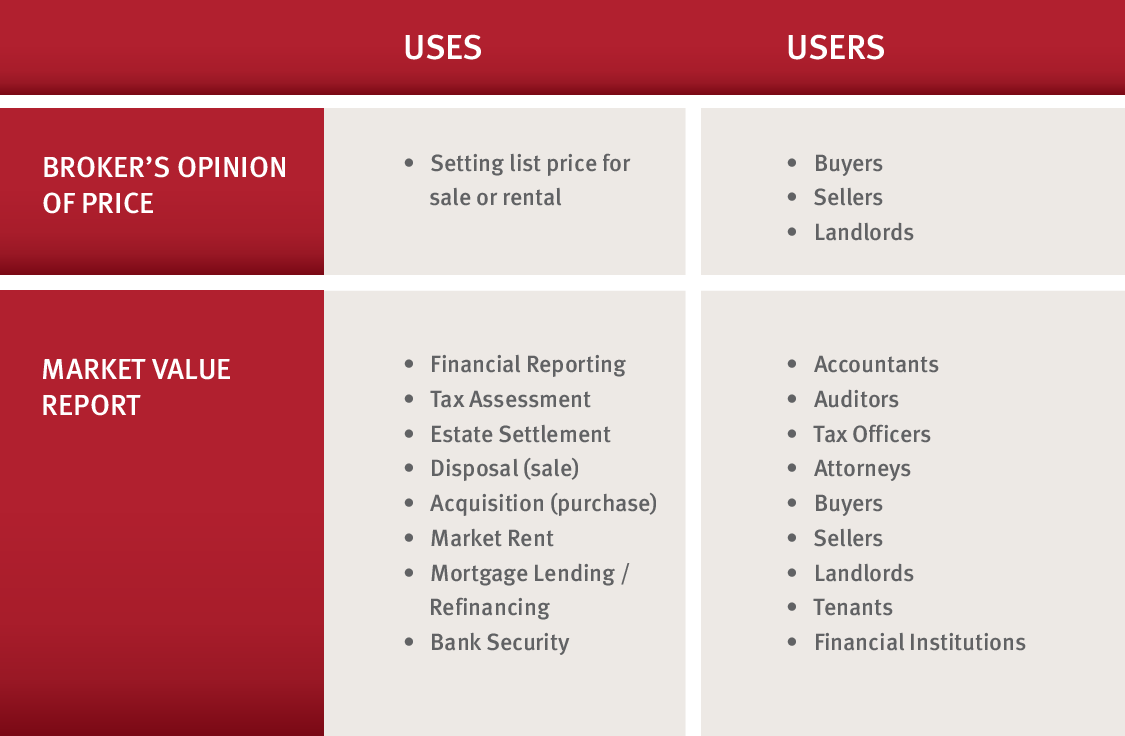

Market Value Reports are usually much more involved than a Broker’s opinion. It is based on international guidelines and Valuers use more than one approach to determine their opinion of current market value for the property. While this process also involves a comparison of your property to others, a Valuer explores the value in more detail by researching land registry records, discussions with agents, information obtained from you as the seller/ landlord and other available market data. The Valuer also considers the replacement cost of your property which requires research of various costs for similar materials and finishes. Valuation Reports include specific descriptions of the property and its surrounding area, including plot plans, floor plans, interior and exterior photos, and details the property’s age, architectural features, physical condition and any needed repairs. Neighbourhood amenities, current and planned development, legal proceedings, and other factors potentially impacting the value of the property are also noted in the report and factored into the property’s market value. The detailed narrative and research required typically result in higher costs when compared to a Broker’s opinion. As shown in the table below, these reports can be used by different parties subject to the original purpose of the report.

Where the Valuer is an RICS Registered Valuer, or works within an RICS Regulated Firm like Terra Caribbean, there are specific reporting requirements to ensure adherence to the global standards, so due to the level of detail involved, a market value report typically takes from a few days to a few weeks, while a Broker’s opinion can be obtained in a shorter time frame. However, since the latter cannot be used for as many purposes as a market value report, when evaluating your property and your goals, consider your requirements carefully to ensure you receive the professional advice most suited to your needs.