Barbados Villa Rental Market

Public information on the Barbados villa market will become much more robust in the coming years. This is due to the implementation of the room levy and shared economy taxes that requires all accommodation vendors to register.

As with last year’s edition, these stats are based on a survey of the websites of the main local villa rental companies, along with the largest international player in the market. This method does not include the properties listed on Airbnb and other similar sites. Like last year, the condo/ apartment sector presents challenges in assessing via this method as the listings on the sites surveyed are often placeholder listings representing multiple units.

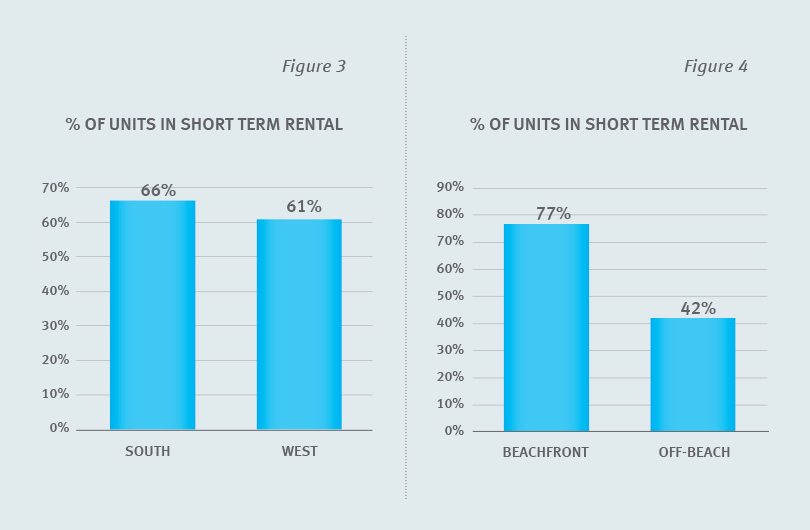

Villas by Room Count

This year’s data show very little change in the split of villa product, with only a slight change to percentage splits by bedroom type. Figure 1. This is to be expected given the pace at which new product enters the market in the villa sector. The main source of change in this segment is driven by property sales – when a new owner may opt not to rent a previously rented property or vice versa.

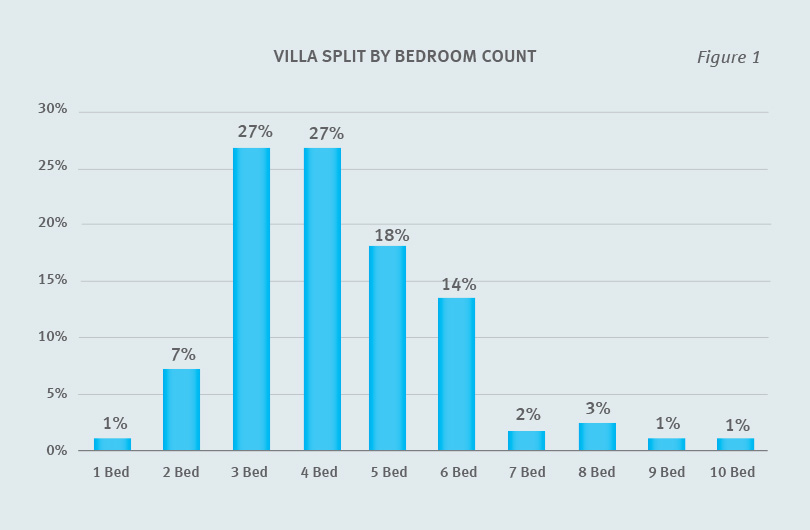

Listing on multiple sites

We have seen a trend emerge in the market where an increase in rental villas are listed with more than one local rental company. While this is becoming more common, the data suggest that the traditional one-to-one relationship is still one that appeals to the bulk of owners as this affords the best control over how and where properties are marketed. As seen in Figure 2 on the opposite page, the bulk of the just over 300 unique villas found in the survey are listed on only one provider’s site, with the extreme being on nine of the twelve sites surveyed.

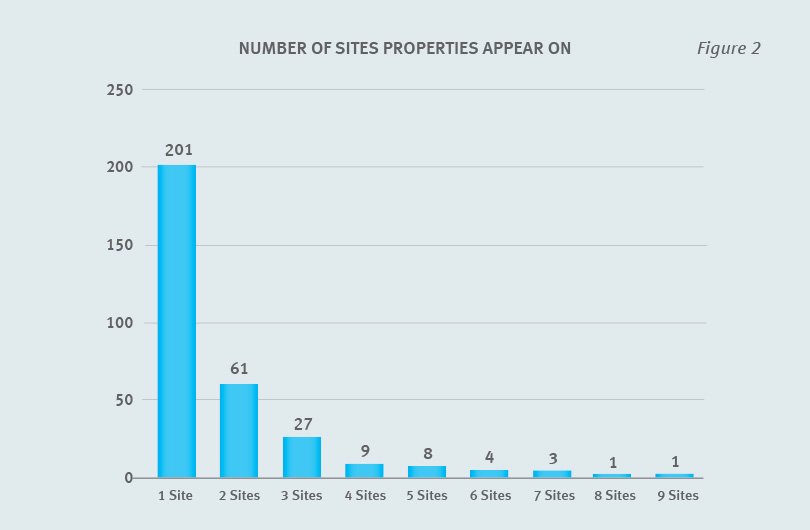

Condominium Use

Although the total number of condo units that are currently in the rental pool is a difficult number to pin down, we can however look at a sample of some of the prominent condo developments and see how many are being used in this manner. It is hard to make a definitive statement on the entire market, however it is interesting to see that the sample shows that on average 63% of the units in a development are on the market for short-term rental. This number relates to our sample only, and speaks to the flexibility short-term rental offers owners for personal use while also generating income which contributes to the property’s running costs.