The Impact of COVID-19 Pandemic Effect the Real Estate Sales Market in Grenada- Analysis of Sales 2021

We have broken down the real estate sales market in Grenada 2021 and 2020 to examine the impact of the pandemic by looking at the total volume and value of sale transactions, performance by parish and by property type. We have also reviewed and analysed sales by classification, price range and unusual (outlier) sales.

2021

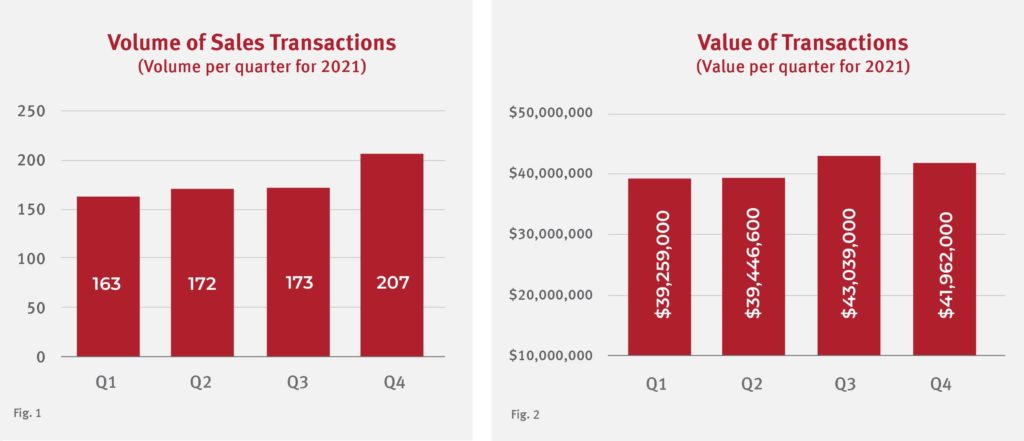

Volume & Value of Transactions for 2021

The total volume of sale transactions in Grenada for 2021 was 715 at a value of approximately EC $163,706,000

- Q1 registered 163 sales at a value of EC $39,259,000

- Q2 registered 172 sales at a value of EC $39,446,000

- Q3 registered 173 sales at a value of EC $43,039,000

- Q4 registered 207 sales at a value of EC $41,962,000

See Figures 1 & 2 below

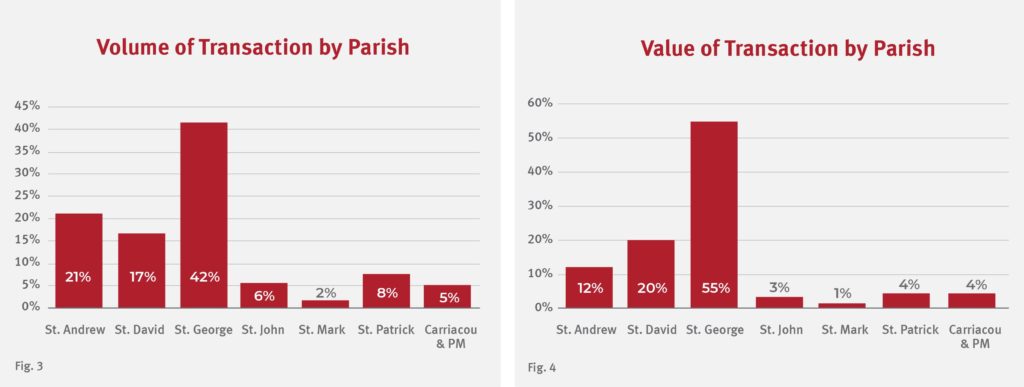

Location by Parish

The location of a property is one of the most imperative factors that influences the achievable sale price (value) and the marketing period required to achieve such price. On a parish-by-parish basis in Grenada, the top performing parishes (St. George, St. Andrew and St. David) have been consistent for several years.

St. George accounted for the highest volume of sales at 42% (298) and a value of 55% (EC $89,866,000) of the total value of sales. The price points for properties within this parish were higher; it registered 63% of the total land sold above EC $200K and 60% of the total improved properties sold above EC $500K.

St. Andrew held the second spot for the total volume of sales, which is similar to previous years. It registered 21% (152) of the total volume of sales and 12% (EC $19,368,000) of the total value of sales. These sales were predominantly a mixture of residential and agricultural sales. St. Andrew recorded 47% of the total volume and 60% of the total value of agricultural sales.

St. David accounted for 17% (119) of the total volume of sales and 20% (EC $32,377,000) of the total value of sales. It registered 19% of the total land sold above EC $200K and 19% of the total improved properties sold above EC $500K. It is expected that St. David will have higher volume and value of sales mainly due to the construction of new accommodation developments/CBI projects, and a constant supply of properties within residential developments.

The other parishes accounted for the total volume and value of sales as follows:

St. Patrick 8% (55) of the total volume of sales and 5% (EC $7,315,000) of the total value of sales. St. John 5% (40) of the total volume of sales and 3% (EC $5,472,000) of the total value of sales. St. Mark 2% (13) of the total volume of sales and 1% (EC $2,164,000) of the total value of sales. Carriacou & Petite Martinique 5% (38) of the total volume of sales and 4% (EC $7,144,000) of the total value of sales.

See Figures 3 & 4 below

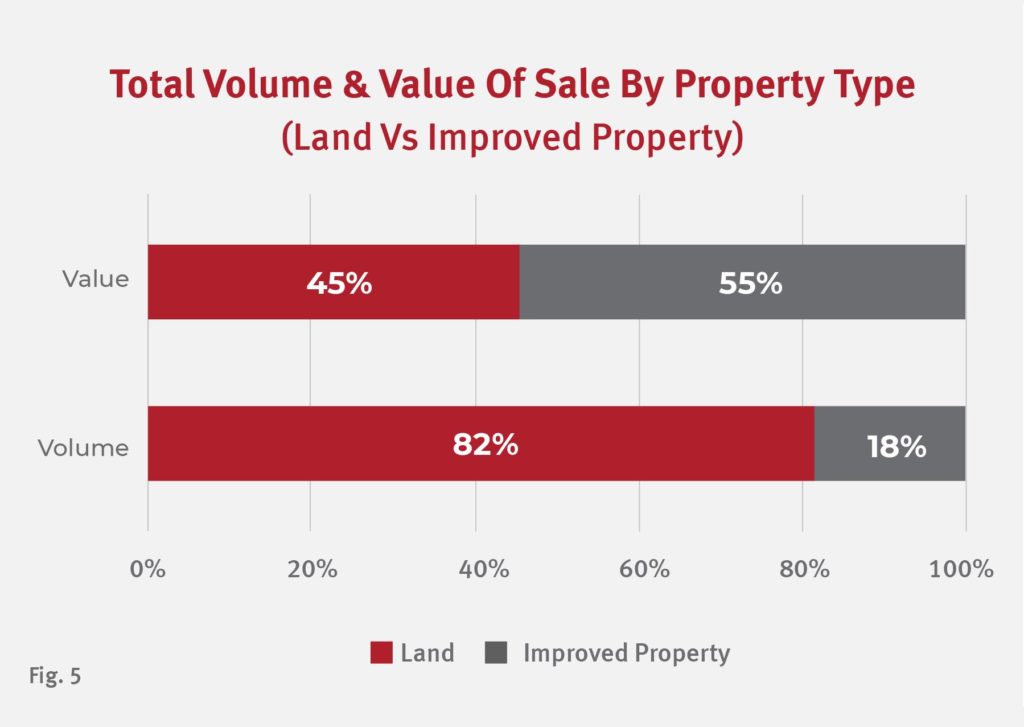

Total Volume & Value of Sales (by Property Type)

Land vs Improved Properties

Land sales were the dominant sales transactions by volume with 82% of the total sales registered; however, as it relates to sales transactions by value, improved property sales accounted for 55%.

See Figure 5 below

Transactions by Classification

Residential, Commercial & Agricultural

Sale transactions were classified based on property use into three categories, namely residential, commercial, and agricultural.Residential properties accounted for the highest volume of sales at 93% (662) and 84% (EC $137,414,000) of the total value of sales.

Commercial properties accounted for a volume of sales at 3% (23) and 15% (EC $24,041,000) of the total value of sales. Agricultural properties accounted for a volume of sales at 4% (30) and 1% (EC $2,251,000) of the total value of sales. These sales were distributed throughout all parishes; however, St. George registered the highest total of residential and commercial sales, whereas St. Andrew registered the highest total of agricultural sales. Commercial properties only make up 3% of the total volume of sales; however, it contributes a larger share to the total value of sales at 15%. This is expected as the price point for commercial sales is usually higher than both residential and agricultural sales.

See Figures 6 & 7 below

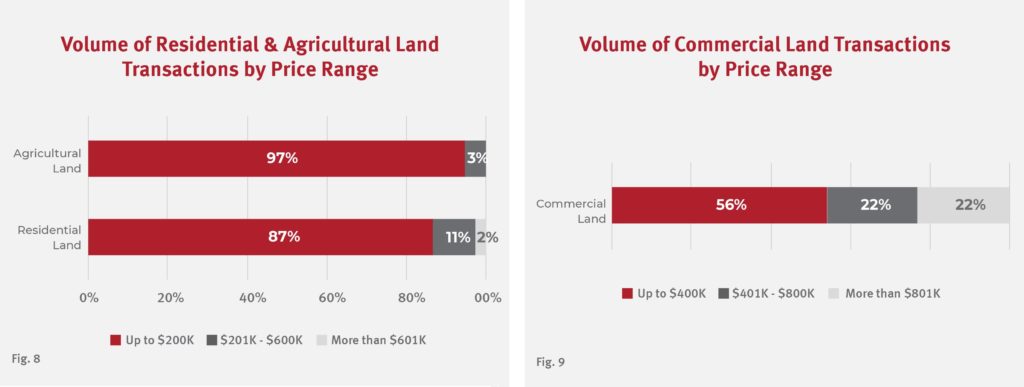

Sales Price Range

(by Land & Improved Properties)

Price is one of the most defining factors in the sale and marketing period of a property. Land prices, as depicted in figures 8 & 9, were classified into agricultural, residential and commercial properties. Agricultural and residential lands were placed into the following three categories: </= $200K, $201K – $600K, and >$601K whereas commercial lands, which usually carry a higher price point, were placed into the following three price categories: </= $400K, $401K – $800K, and >$801K.

See Figures 8 & 9 below

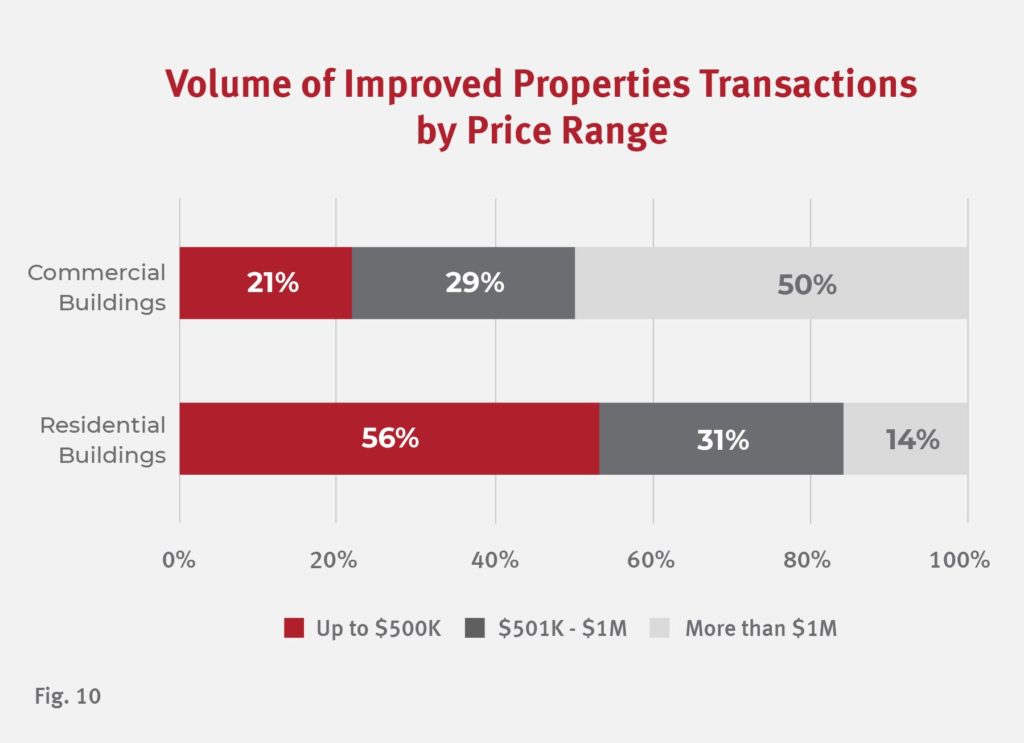

Improved properties prices, as depicted in figure 10, were classified into residential and commercial properties and then placed into the following three price categories: </= $500K, $501K – $1M, and >$1M.

See Figure 10 below

Outlier Consideration – The CBI Effect

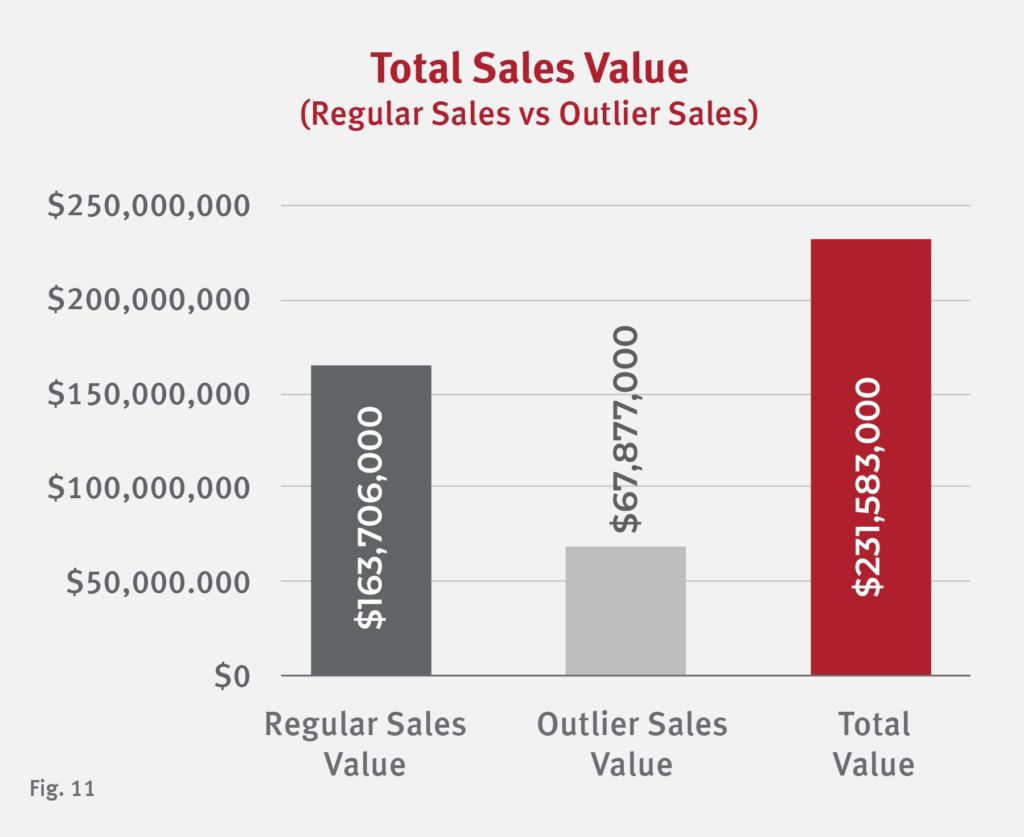

Some property transactions were isolated from the previous analysis for regular sales as they were deemed outliers given their ultra-price range, and terms and conditions of the transactions. These sales were still reviewed and analysed as they have a significant impact on the Grenada real estate market.

A total of 43 outlier sales were registered for 2021, which accounted for a total value of EC $67,877,000. These sales were predominantly Citizenship by Investment (CBI) sales and large development sites for CBI/hospitality purposes.

As noted previously, regular sales accounted for a total value of EC $163,706,000. When the outlier sales are included, the grand total of all sales registered in Grenada is EC $231,583,000. This shows that the outlier sales contributed 29% of the overall total value of sales in Grenada.

See Figure 11 below

NOTE: It should be noted that the total value of the CBI unit sales was those sales conveyed to unit owners and registered by the Deeds and Lands Registry. This also includes the transfer of a large villa type property between related entities.