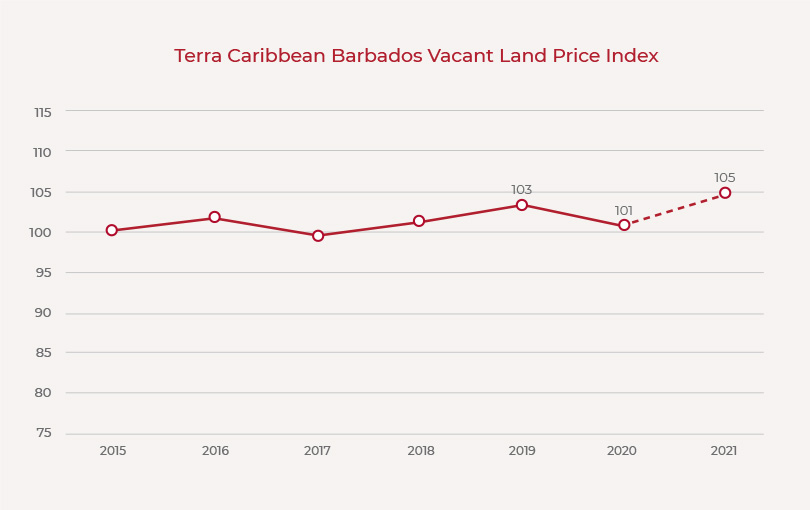

Terra Caribbean Barbados Land Price Index

Given the size of the Barbados real estate market the accessibility of market information continues to be a challenge when seeking to understand trends and track performance over time. The market volume when measured by change of ownership records is just over 2,000 properties annually in recent years. In the past we have based our land price index on a combination of external records and our own transactions and investigations of the market to build a robust representative data set which allowed us track changes in this sector over time. This year we improved our external data sources and now have a much more comprehensive set to add to our own analysis and felt the time was right for a rest of the base year. As such our new base year is now 2015 and as other analysis has shown, like real estate overall vacant land has weather the uncertainty of the corona virus well.

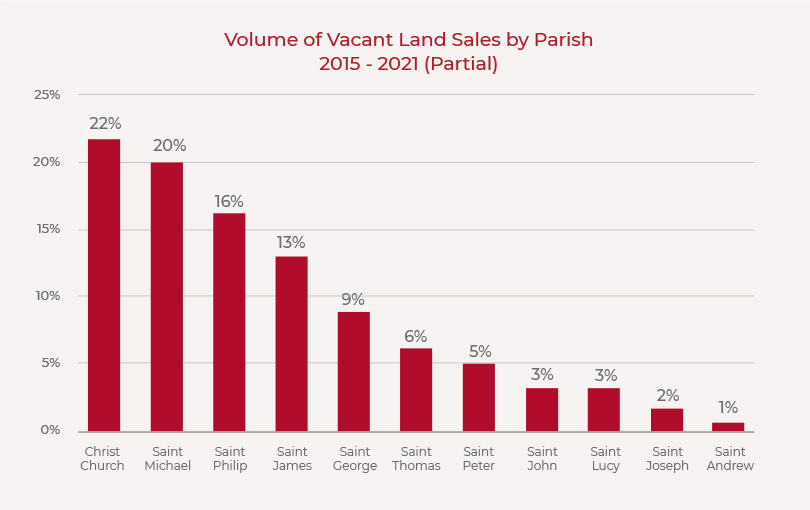

Land subdivisions continue to be a large factor in this sector with both residential and industrial featuring strongly in the data set. Indeed, one only need to look along Highway R at the number of developments that have been established. This is a large contributor to the volume of transactions we see in Christ Church and results in that parish accounting for the largest number of transactions in the data set. The data indicates that nearly 90% of the recorded vacant land transaction in the period were residential, commercial, the next highest land use type, at just 1.5% of the transactions.

Volume of Sales by Parish

Shown below is the distribution of transactions by parish during the period (2015 – July 2021), as mentioned above Christ Church remains the parish with the largest volume of vacant land transactions. It is worth noting that while land developments feature heavily in the data for Christ Church and St Phillip this is does not appear to be as large a factor in St Michael, but it remains in second place. This does not mean there are no such projects indeed the presence of nonresidential developments in the St Michael set is worthy of note.

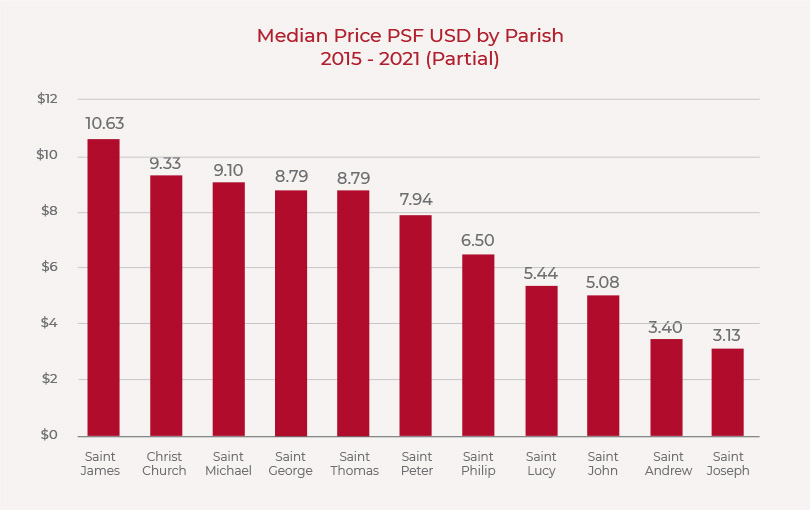

Median Price Per Square Foot by Parish

Median price PSF by parish remains very similar to the last time we analyzed the data with St James retaining its premium, however the gap appears to have closed to the rest of the market. One trend we have observed is purchasers opting in some cases to buy existing properties and remodel, renovate or in some cases completely rebuild, with several examples found along Old Molyneaux Road in Sandy Lane. The volume of these is not significant yet but could grow in the future as vacant options in these highly desirable addresses become less available.

The rest of the parishes largely maintained their ranking with St George and St Lucy each gain a place at the expense of St Thomas and St John respectively being the only changes from our last publication of the index.