Long-Term Rental Market Insights

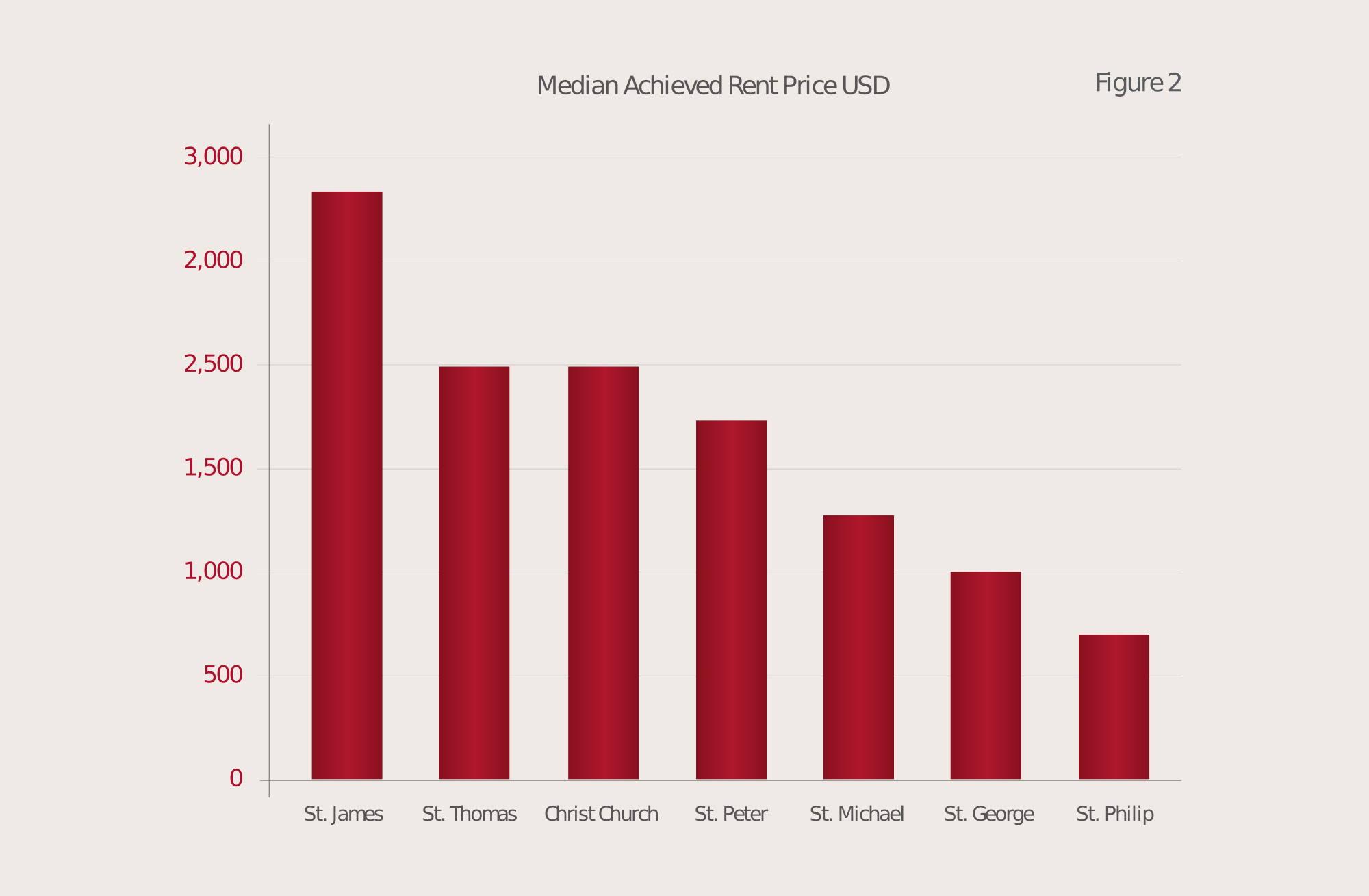

The chart below (Figure 1) shows the median rental price achieved for a sample of residential rental properties in Barbados over the last two years. The one to three-bedroom range is relatively stable during this period, however we do see, large swings in the homes four-bedrooms and above. In a small and imprecise market, it is not uncommon to see this variation in prices. Two main factors that impact results are the smaller volume of data in the sample for properties of this size, and the location of those properties in the sample within high-end or luxury developments or neighborhoods. The most recent median achieved price is noted next to the chart.

We cannot comment on the long-term rental market in the last two years without noting the impact of Ross University School of Medicine (RUSM). Quarter four of 2018 saw rental volume in excess of double the average volume seen in the previous seven quarters. This can be directly attributed to the staff of RUSM absorbing a significant proportion of the available supply in the market and notably changing the demand dynamic. This spike is not likely to have a continued effect on market volume but there may be a less dramatic spike when the student population’s choice of accommodation expands beyond the dedicated units at Coverley.

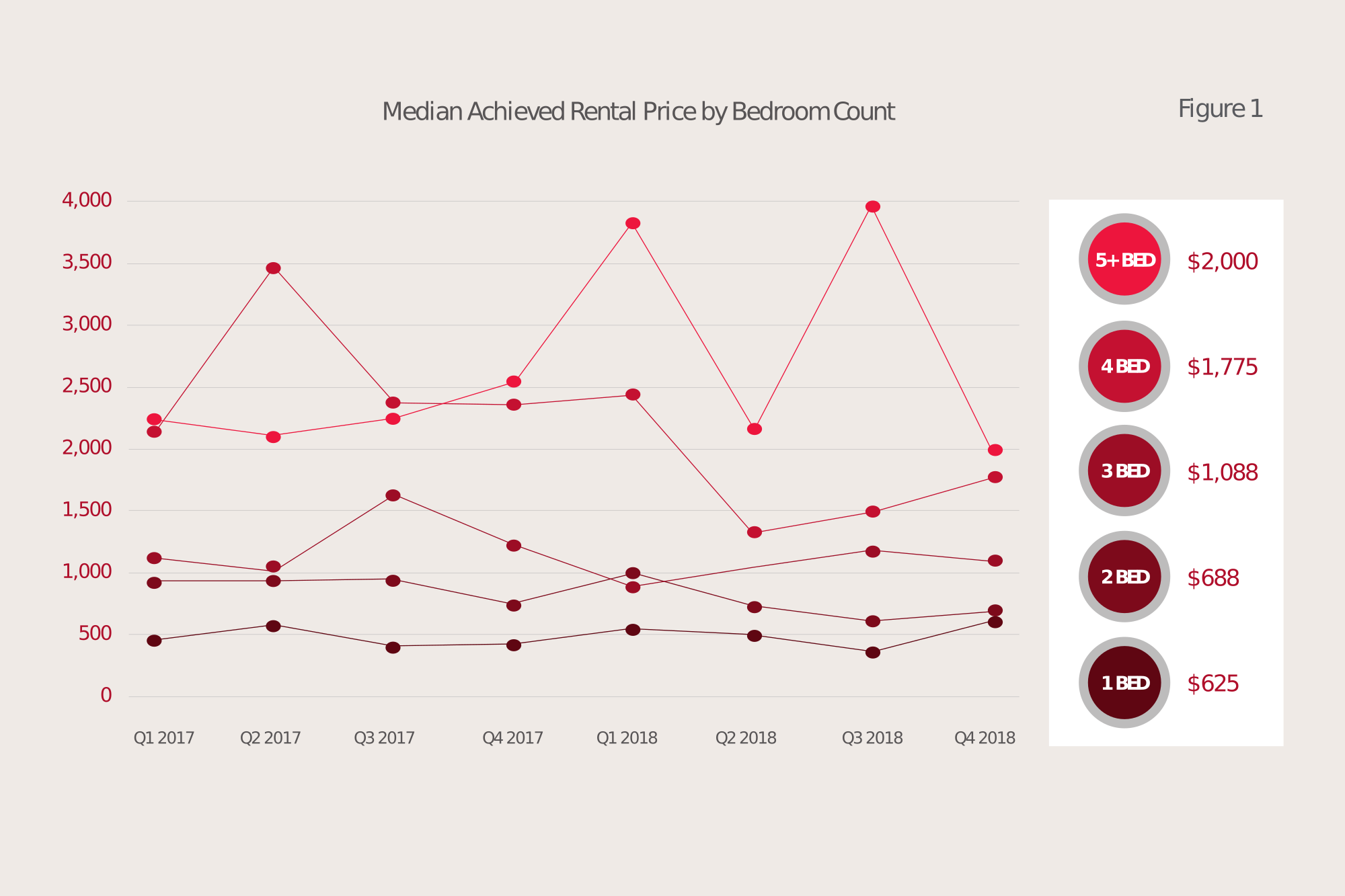

Looking at median price by parish (Figure 2) we can see St. James leading as it contains the highest concentration of beachfront and other luxury developments. The median price in St. Thomas may seem unexpectedly high, but this can be attributed to the presence of the cluster of accommodation in and around the Millennium Heights development, one of the areas which has proven popular with RUSM staff.