Land Tax ALERT: Barbados

If you haven’t already received your land tax bill, be on the lookout! Land tax bills will soon be issued, and this is a revaluation year where the Barbados Revenue Authority (BRA), will have completed their triennial revaluation process. You may have even seen the Officers conducting their inspections over the last two years.

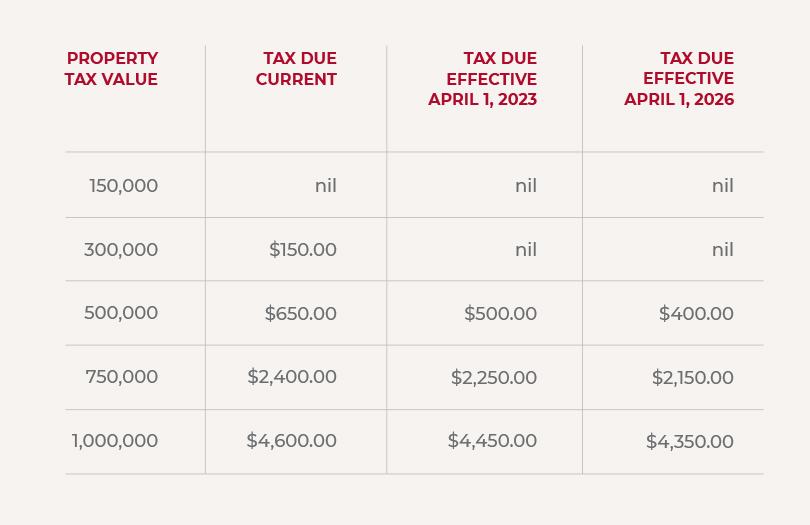

When you receive your bill take careful note to see whether the assessed site value (for vacant land) or improved value (for built properties), has changed on the land tax bills. In the 2022 Budget, the Honourable Prime Minister Mia A Mottley advised that land tax relief would be on the cards, and proposed an increase to the threshold for residential properties which do not incur land tax from $150,000 to $300,000 effective April 1, 2023. Subsequently the threshold will again increase to $400,000 from April 1, 2026.

Taxpayers must pay the tax due or risk incurring penalties and interest but are also allowed to file an objection in writing, to the Revenue Commissioner within 21 days of the tax assessment issue date. Objections can only be filed on the following grounds:

1. The values assessed are too high or too low

2. The lands which should be included in one valuation have been valued separately

3. The lands which should be valued separately have been included in one valuation

4. The person named in the notice is not the owner of the land

The BRA reviews objections received and on completion of their analysis, the Officer either

(i) overrules the objection in which case there is no change to the values or land tax assessed, or

(ii) the Officer reduces the site/improved property value in whole or in part, and the property tax

is re-assessed, potentially resulting in a refund to the taxpayer.