Key Considerations for Valuing Commercial Property

Investors in commercial real estate are primarily focused on maximising their return, thus the level of income generated by the property is usually the major component of the property’s value. A lease document is the standard contract for businesses, so when valuing a commercial property, there are some key lease clauses which Valuers consider as these directly impact the value of a property.

- Premises – This is specific to the location and area of tenancy and ultimately guides the instruction on what is being valued. This also defines the areas for which the tenant is responsible for any repair and maintenance, as well as those areas for which the landlord is responsible. As the building size and tenant count increase, so too does the complexity of the valuation process as Valuers must analyse the revenues and costs associated with each tenant space.

- Term specifies the period during which a tenant is entitled to possession of the leased property. Even though a term does not legally start until the date of the lease, there is nothing to prevent the landlord and tenant from agreeing to be responsible for obligations, such as payment of rent, outside of the lease agreement. In this case, the rent commencement date is used to determine when the lease has started. The term of the lease and the rent commencement date are the main parameters used by the Valuer to understand the period over which income is to be generated and analysed.

- Rent is the sum payable by the tenant to the landlord for use of the property. Rent can be paid by installments and can be on advance, or on arrears based on an agreed period. In addition to the base rent there are other incentives which will also impact the property’s income. Such incentives include rent free periods, reduced rent periods, fit out contributions, other capital contributions, and even reverse premiums paid by landlords for tenants to take leases. These incentives must be considered when modelling cash flows over the duration of the lease. A Valuer also considers whether the rent paid – based on the location and square footage of the premises -is in line with market. Where the rent is not in line with market, analysis of the difference between the market rent and lease rent (whether higher or lower) is typically performed.

- Service or Common Area Maintenance (CAM) Charge outlines a list of services to be provided to the tenants, the costs that are recoverable from tenants and a mechanism for recovering payment from tenants. Service charge is key in identifying what costs are borne by the tenant, and those borne solely by the landlord, which Valuer’s must consider in any income analysis.

- A Rent Review is a means of periodically adjusting the rent, usually done every 3 to 5 years. The benchmark is the rent likely to be achieved at the date of review on the open market. Where the lease does not specify a rent review date, the Valuer must make assumptions on future changes in rent based on market conditions, and analyse accordingly. If the rent at the review date is above market, a reversion to market will have a negative impact on the overall income stream, while a below market rent will have the opposite effect.

- Termination clauses detail the circumstances under which the parties may end their legal relationship and discontinue their obligations under the agreement. Where the lease outlines termination circumstances and any are known to have occurred, e.g. when a tenant provides or is given notice, the Valuer must consider the impact of vacancy on the property’s revenue stream. This must be reviewed along with the likely lease up period and related costs which the landlord must bear until a new tenant is found. These costs can include marketing fees to advertise a property, brokerage commissions where an agent is engaged to source new tenants, and maintenance costs which would otherwise have been borne by the departing tenant. Valuers include these expenses in the income / yield analysis as a reduction of operating income.

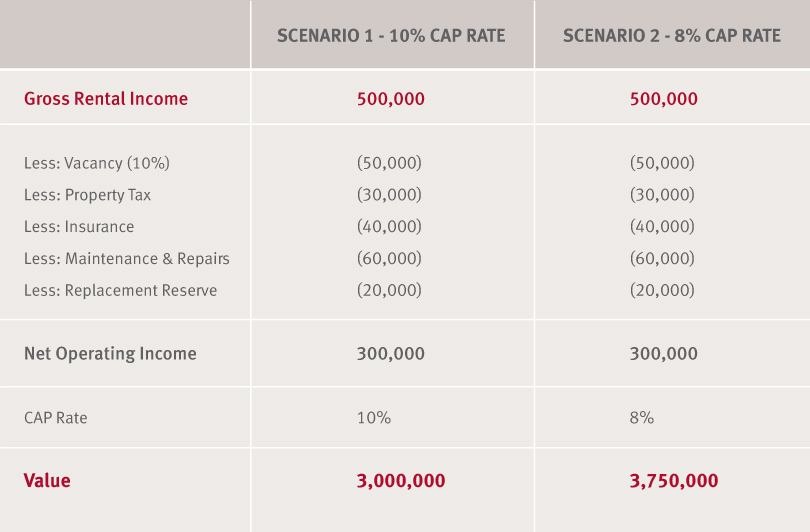

- Capitalization (CAP) Rate: The CAP rate is another metric significantly impacting commercial valuations and is used in the income / yield analysis. The rate used is what investors expect to earn as a percentage of their investment, on an annual basis and is best understood as a measure of investment activity, and the risk associated with an investment. For example, a property with a CAP rate of 10 tells a buyer that he should expect a 10% return on his investment assuming a debt free transaction.

In general, the lower the CAP rate, the lower the risk of the investment and the higher the property’s value. A higher cap rate means an investment is considered riskier and results in a lower value. A simple illustration of this concept is shown below.

This type of analysis is one of the standard approaches for valuing any commercial property. While the Valuer also considers the location of the property, size, age and condition of the premises etc., for commercial properties – particularly where the income generated is driven by the lease and the CAP rate derived from market activity – the income is a key component of the property’s value.