Barbados Budget 2022 Real Estate Impact

In the Budget delivered on March 14, 2022, the Honourable Prime Minister Mia A Mottley advised that land tax relief would be on the cards from the fiscal 2023 year and onwards.

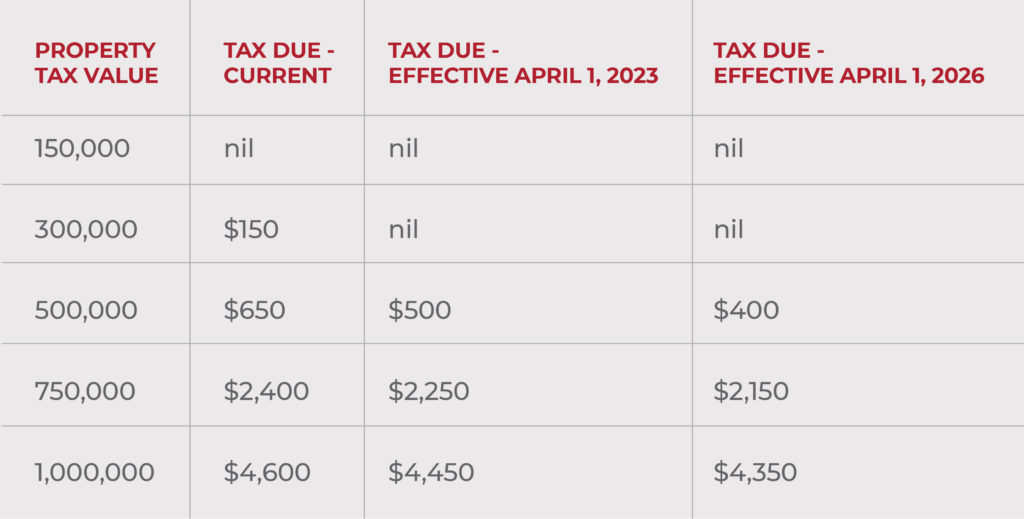

The Prime Minister has proposed an increase to the threshold for residential properties which do not incur land tax from $150,000 to $300,000 effective April 1, 2023. Subsequently the threshold will again increase to $400,000 from April 1, 2026.

It is not clear whether this change will affect the other tax bands for residential properties, however assuming these are not affected and that the existing tax rates remain the same, residential property owners can expect reductions in their property tax bills (subject to assessed value) over the next few years as shown in the table below.

We highlight that fiscal 2023 is a revaluation year for the Barbados Revenue Authority and further changes to the property tax rates or bands may yet arise. When your bill is received next year, any objection to the assessed value must be lodged with the Barbados Revenue Authority within 30 days based on approved criteria for objection, and potentially supported by an independent valuation.

If you have any queries please feel free to reach out to your preferred Terra Caribbean contact.