Banking on the Beach

The recent three years have seen phenomenal growth in luxury travel to Barbados. Luxury travel has always been a key leading indicator for the property sales market, so as villa occupancy and average daily rates continue to increase, so does the market’s expectation that sales volume will soon follow. The principle that ‘value follows volume’ remains true, so without an increase in trading volume the prospects for price growth remain distant.

Broadly the industry view is that although some buyers are still sitting on their hands, sentiment is improving and confidence is returning to the market. Three local factors that have played heavily into this sentiment are:

i. Trophy sales (villas >$15M) always seem to energise the market. The market usually sees one of these per year. The recent sales of a significant villa in Gibbs and another in Mullins have received considerable airtime

ii. The much publicised banner sales volume being experienced at Royal Westmoreland, the highest levels in the history of the resort

iii. Construction of super villas in Sandy Lane. There are a number of villas which are under construction or recently completed which would have replacement costs in excess of $25M

Quite often the industry is squarely focused on signs of increasing demand, with the term green shoots becoming part of the daily grammar. The supply side of the equation is however an important factor and should not be ignored. So whereas an increase in demand is encouraging, there can be no price growth within any particular segment until any excess supply is absorbed. Little research has been published on the subject, so this year we thought we would look at supply, focusing our attention on the west coast beachfront.

Supply Data

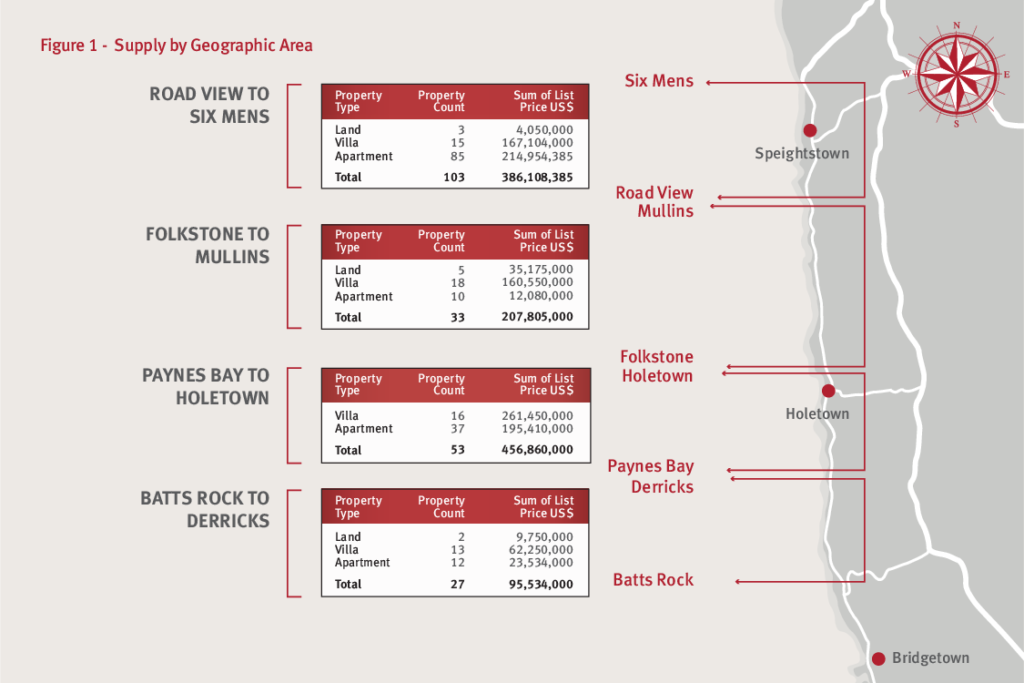

Figure 1 illustrates the total supply on the west coast beachfront segmented into four geographic areas. The overall supply of property is a staggering $1.15 Billion, with villas making up 57% of the stock, apartments 39% and land just 4%. The highest concentration is in the Paynes Bay to Holetown area where there are a number of villa developments being marketed and one apartment development with approximately $135M in stock. The north of the coast is next where there are two significant apartment developments being marketed and also one notable residence offered for sale at $125M. The southernmost geographic segment from Batts Rock to Paynes Bay has the lowest supply across all metrics including overall sales value, property count and average price.

The unit count by type is illustrated in Figure 2. The apartment segment is notable with a mix of new and resale product making up the 144 unit count. The villas and land parcels combined are at 50% of the apartment stock. Also of note are the average list prices per square foot by property type. The apartments are tracking at $860 per square foot which is about par for the course and still about 15% below peak prices of 2007. Villas are at $1,453 per square foot and vacant land is averaging $9M per acre. It would be important to remember that these all reflect list pricing so the actual achieved prices would be marked off these prices.

The overall dispersion of pricing indicates that 70% of the $1.15B in inventory is represented by properties listed at or above $5M. It is also notable that with 27 properties in the $10M plus range, the market is looking for that many purchasers with a likely minimum net worth of $100M or more.

Insights

Ten years ago supply was chasing demand, however today the market is still sitting on 10 years of inventory with the condo market the most exposed. This has had the effect of creating incidental landlords with some developers opting to offer unsold product in the holiday rentals market in an effort to drive interest. Whereas there was a swing towards the condo market ten years ago with a number of hotels being converted into condos, the pendulum now seems to be swinging in favour of the villa product with approximately 100 planned apartments now cancelled and developers favouring the villa model. In addition to staying clear of the condo stock, this approach is somewhat de-risked as many developers are waiting on a willing purchaser before commencing construction.

Development funding remains limited and characterised by increasingly onerous terms, with most banks mandating even greater latitude to intervene when benchmarks are not met. Import duty and tax concessions continue to play a key role, with virtually all developments seeking them in some form, whether under the Tourism Development Act (TDA) or a hybrid thereof.

Additional supply will likely be added when the Four Seasons development is resurrected and a new development is launched in the Batts Rock area. Prime locations and quality product will get buyers’ attention. It is notable however that most of the larger developments on the beach are generally well-capitalised so purchasers sitting on the sidelines should take advantage of the current low levels of pricing. Don’t look for any new supply in the condo segment any time soon, the south coast is likely to be the next frontier as all of the existing supply has been fully absorbed with a boutique development on Accra beach recently achieving record-breaking prices.

Although not part of the traditional offering, the trend towards fractional as an alternative ownership option will continue as a partial solution to the oversupply, however thus far the wider market is yet to embrace this concept. Given the existing supply dynamics, we may well see a development trend where the market goes full circle towards the more traditional hotel product in the near future. At present the hotel room count on the west coast beachfront is approximately 1,350 keys, however a number of these properties would benefit from renovation and repositioning to modernise the plant. The villa and apartment product continues to offer a compelling alternative to the traditional hotel product particularly in the luxury segment of the market.