Terra Caribbean Market Report: 2024 Sales in Review – Barbados

SUMMARY

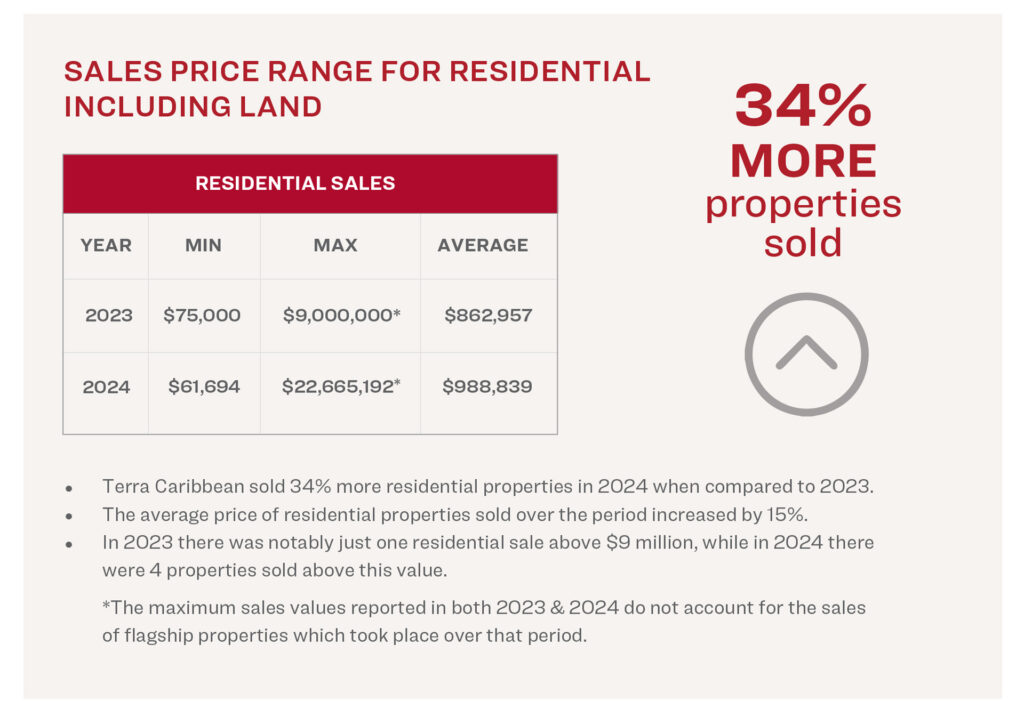

In 2024, Terra Caribbean experienced strong growth, with a 34% increase in the number of properties sold compared to 2023. Sales enquiries rose by 22%, 1 percentage points less than the growth in sales, indicating an improvement in conversion rates.

The average sale price rose by 15%, while the average discount between list and sale prices fell by 0.8% to 3.2% – the lowest level in five years – signaling a more competitive market.

Additionally, pending sales as at January 1, 2025, were 39% higher than on the same date in 2024, marking a strong start to the new year.

The Details

- Sales of residential properties below $500,000 remained relatively steady, rising by 6%

- The $500,000-$1M range saw nearly double the sales in 2024.

- This surge was driven by the completion of The Estates in St. George, Coral Beach in St. Peter, and new homes in The Villages at Coverley.

- Properties under $1M accounted for 79% of all sales in both 2023 and 2024, highlighting strong demand in this segment.

- The $1M-$1.5M range experienced a significant 78% increase in sales year-on-year.

- This increase was lead by the sale of houses, townhouses and apartments concentrated on both the west and south coasts.

- While sales declined by 19% in the $1.5M-$2M range and 22% in the $4M–$6M range, the overall luxury market remained robust.

- The number of properties sold above $1.5M increased by 10%, with a 32% jump in the $2M-$4M range and an impressive 250% increase in the $6M+ segment.

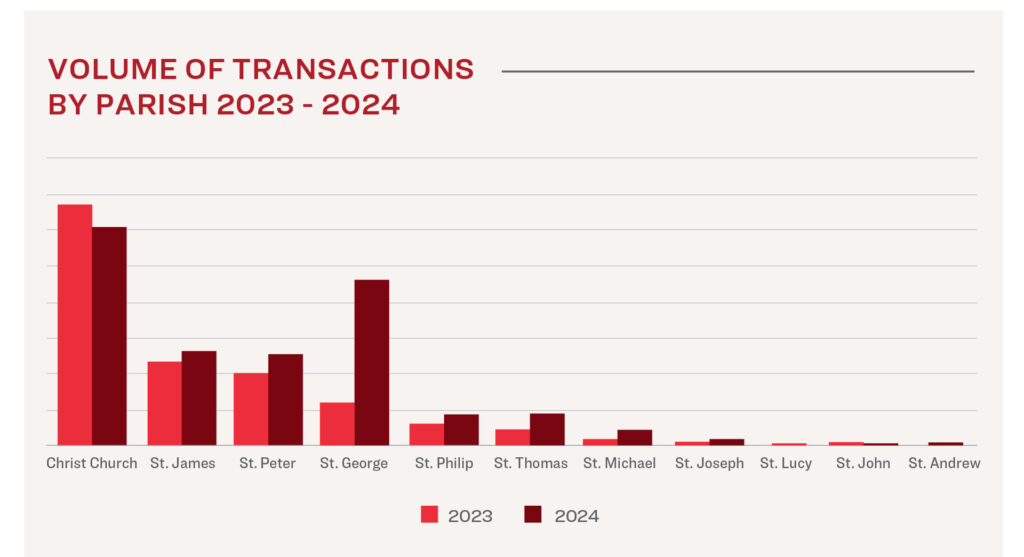

- Christ Church remained the most popular parish, representing 33% of sales transactions in 2024. Average prices surged by an impressive 52%.

- St. George followed, with sales significantly boosted by the bulk closing of apartments at The Estates, accounting for 25% of transactions. Average prices in this parish more than doubled as a result.

- St. James and St. Peter, traditionally among the top three most active parishes, each accounted for 14% of market share. Average prices rose by 18% in St. James and 14% in St. Peter.

- In St. John, despite one less sale than the previous year, the average price skyrocketed by 518%, driven by the sale of a historic plantation home.

- No properties were sold in St. Lucy in 2024.

- While interest in other parishes grew by 1% to 5%, average prices declined by between 11% and 57%.

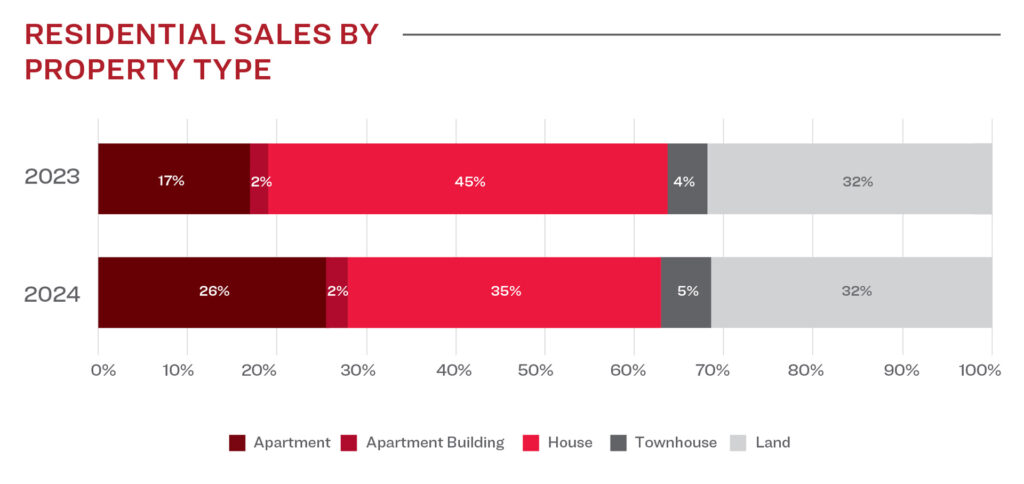

- Apartment sales doubled in 2024, capturing 26% of the market share. A large portion of these sales were driven by developments like The Estates.

- While the inventory of well-priced apartment buildings is low this property type continues to be attractive to potential buyers.

- The number of houses sold in 2024 remained steady, increasing by 5% and accounting for 35% market share.

- Land lot sales reached their highest level in the past five years increasing by an impressive 32% over 2023, driven by strong interest in Carmichael Crescent, which offers attractively priced lots starting at $85,000.

- While the market share commanded by townhouses. Increased by just 1% there were 67% more townhouses sold. Demand in this segment is high and there are a number of new projects under construction with limited units remaining at projects like Sorrento and Ayana by the Escape Development team.

- Average discount levels between Listed Sale Prices and Agreed Sale Prices fell by 0.8% to 3.2%, reaching their lowest level in five years.

- Multiple properties received simultaneous offers in 2024, with several selling above the asking price.

- Significant discounts were seen primarily in forced sales or for properties initially priced above market, spanning various price segments.

- 28% of properties sold at a discount of 1% to 10% from the Listed Sale Price.

- Notably, 43% of sales were agreed at the Listed Sale Price.

LEAD VOLUME & PENDING SALES **

** Pending sales measures the value of sales agreed and awaiting settlement as at January 1st.

SOURCE OF BUSINESS:

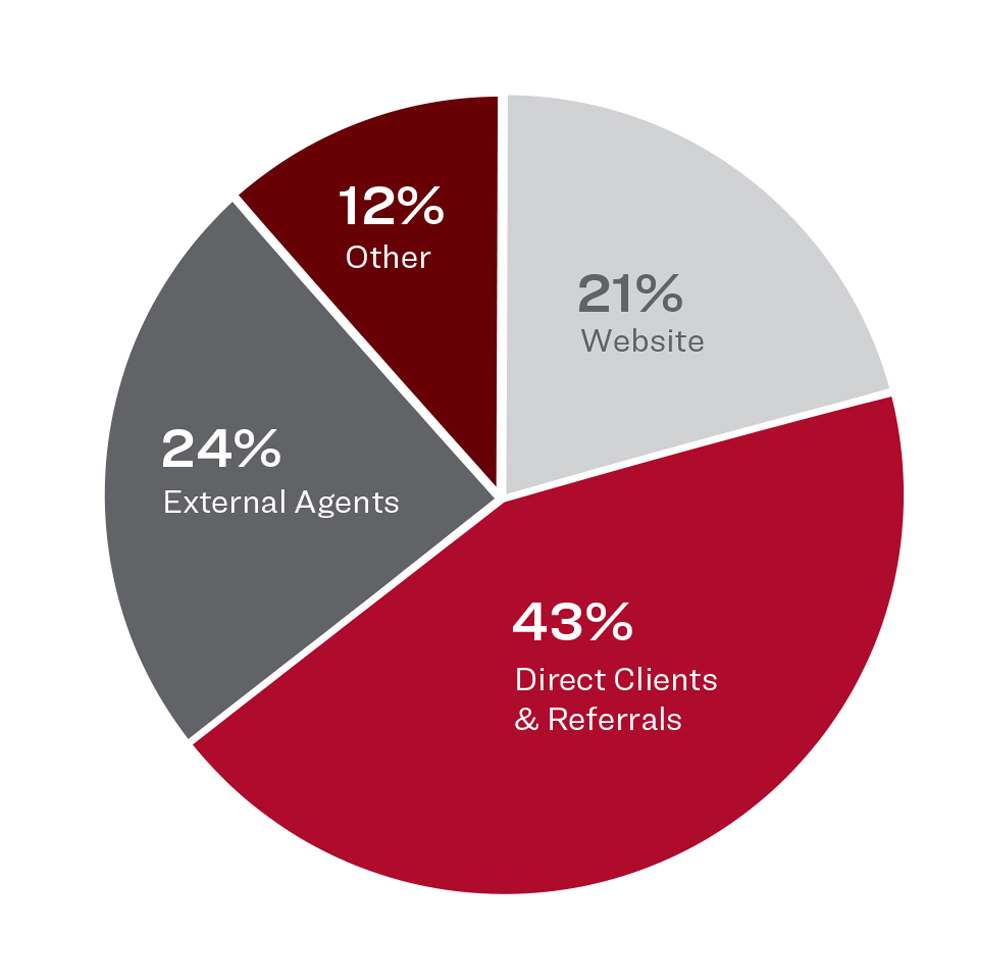

- Direct clients and referrals remain our strongest source of Sales & Rentals leads, contributing 43% – a reflection of the trusted relationships built by the team.

- Websites (21%) and collaboration with other agencies (24%) also play a significant role.

- Events, signage, and other advertising channels account for the remaining 12%.

- These figures are consistent with historic trends.

THE DATA IN THIS REPORT IS SOLELY FROM THE TRANSACTIONS COMPLETED AND STATISTICS RECORDED BY TERRA CARIBBEAN.

THIS REPORT FOCUSES ON RESIDENTIAL PROPERTY SALES

All prices are quoted in Bds$.