Residential Sale Insights: Trinidad & Tobago

Despite pitfalls in the economy, demand in the middle to lower Residential Sale segment has remained stable over the last 5 years. However, the composition of types of property and price ranges has changed to match that of changing consumer demands.

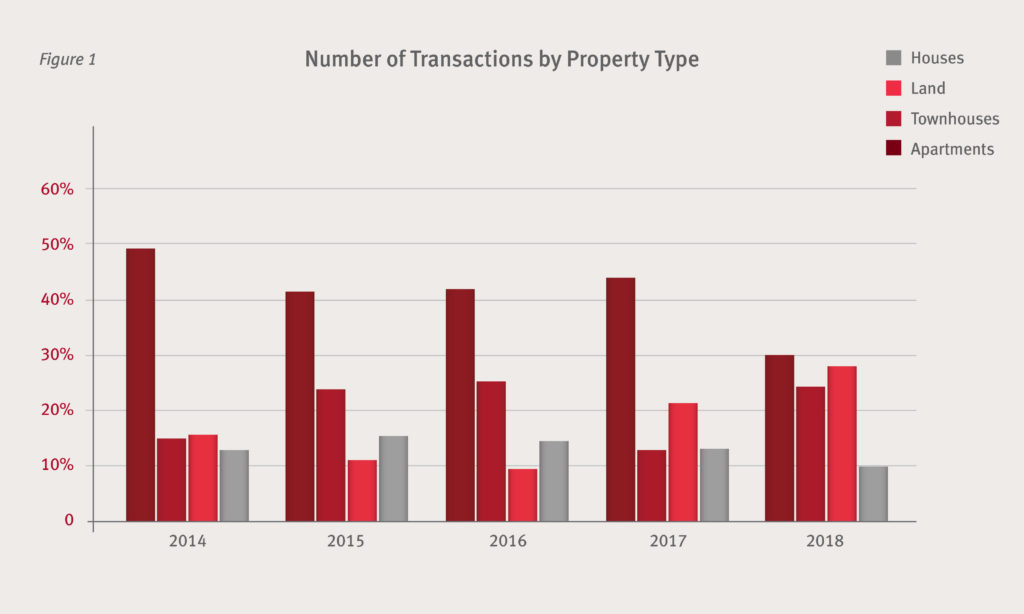

Based on our data, house sales declined within the year 2014 to 2015, remained steady through to 2017, and then declined in 2018. Moreover, the disparity between house sales and combined sales of townhouses and apartments has decreased over the 5 year period, concluding in an excess in combined townhouse and apartment sales of 10% over house sales in 2018. This trend can be attributed to market forces.

On the supply side, the scarcity of available land in densely populated high-demand areas and the respective costs have driven residential developers to construct multi-family dwellings to maximize on land size as well as building costs.

On the demand side, townhouses and apartments are more affordable properties for the market that presently has the purchasing power and are an alternative to houses of the same age. Therefore, the demand for these properties has increased over the past 5 to 10 years as the supply of middle to lower income housing has increased. Additionally, the added benefits of security and low-maintenance living have lured a younger, buying population to these new developments.

The category of land continues to be a strong seller. Well-priced land in single family developments offers an opportunity for even the sole financier or lower income family to buy and in some cases, subsequently use the land as equity.

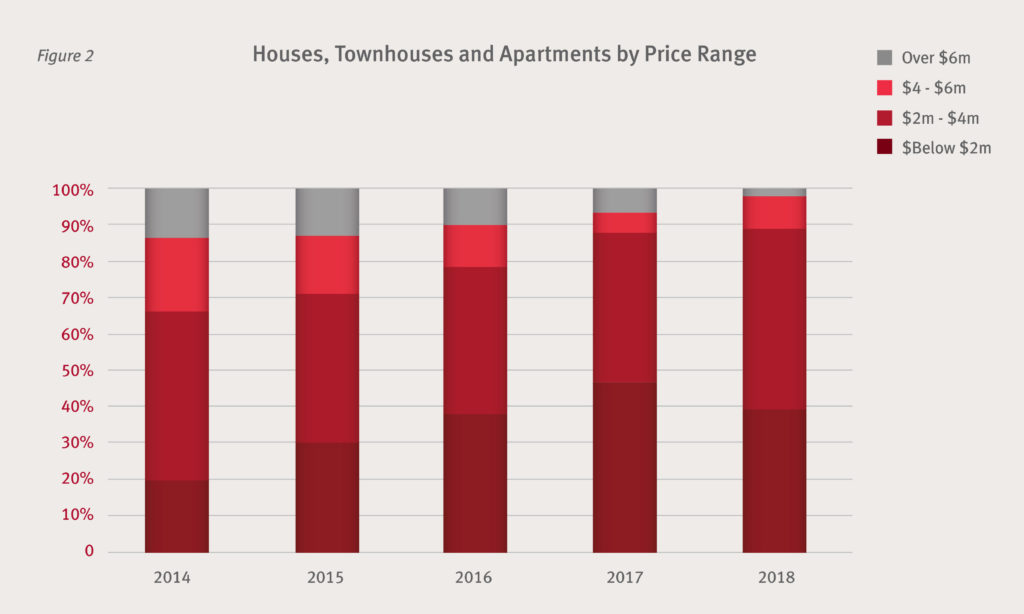

During 2014, sales were prominent in the $2m to $4m price range. However, as the economy declined in late 2015 to 2016, sales in the $2m to $4m bracket decreased by 5% over the period of 2015 to 2017. Simultaneously sales of houses, townhouses and apartments priced below $2m increased by 27% from 2014 to 2017.

Throughout the period 2014 to 2017, sales in the $4m to $6m price range also decreased incrementally and sales in the over $6m bracket continued to dwindle through to 2018. Though the economy has not recuperated fully, 2018 marked a change in sales as homes in the $2m to $4m bracket, as well as the $4m to $6m bracket have increased by 9% and 3% respectively, from 2017 to 2018.

While this data does not encompass all residential sales in the country over the 5 year period, sufficient data was gathered to render it representative of the residential sale segment.