Real Estate Rental Market Performance Report Q1 – Q2, 2024

LEAD INDICATORS

The team has reported that there is a general lack of inventory, making it challenging for tenants seeking options. Several new projects have recently been completed or are scheduled for completion within the next 18 months, which should positively impact inventory. Developments such as The Estates, Allure, Aspire, The Residences at Porters Place, Sorrento, Residences at Coverley, and Atlantic Breeze are among the most anticipated. These projects are expected to significantly improve the current inventory shortage, particularly within the BDS $2,000-$10,000/month rental range.

Holiday rentals play a pivotal role as a lead generator for the Terra Team in both long-term rentals and sales. Therefore, it is important for us to follow key trends in that market, which will, in turn, have an impact on both sales and long-term rental transactions.

Tourist arrivals are showing a robust increase, up 18% year-on-year and 2% above 2019 levels. The T20 World Cup has significantly contributed to this growth, enhancing the appeal of the destination. In addition, increased airlift from key markets, including the UK, Canada, and the

Tourist arrivals are

showing a robust

increase, up 18%

year-on-year and 2%

above 2019 levels.

USA, has further supported this upward trend.

This combination of events underscores a

strong recovery and growing interest in travel

to Barbados.

Our sister company, Blue Sky Luxury, is on par with 2023 overnight villa stays which was a record year. They are seeing higher occupancy numbers in apartments and villas since COVID. This is certainly positive – however, it will impact long-term inventory levels. As a small island, the demand for short-term rentals provides property owners with the flexibility to use their properties for personal use. This dynamic can limit the availability of long-term rental options, potentially impacting residents and long-term visitors. It’s essential to monitor these trends closely to balance the needs of both the rental market and the community, ensuring sustainable growth in the future.

Q1 & Q2 ACHIEVED RENTAL PRICING

The number of properties rented has returned to 2019 levels, indicating a stabilization in the market following the disruptions caused by COVID and the Welcome Stamp Initiative. The peak in rentals during 2021/22 was largely influenced by the welcome stamp initiative and a surge in mid-term rental demand due to COVID-19, which created a unique market environment. This demand aligned perfectly

with the island’s abundant inventory, as short-stay arrivals were absent during that period.

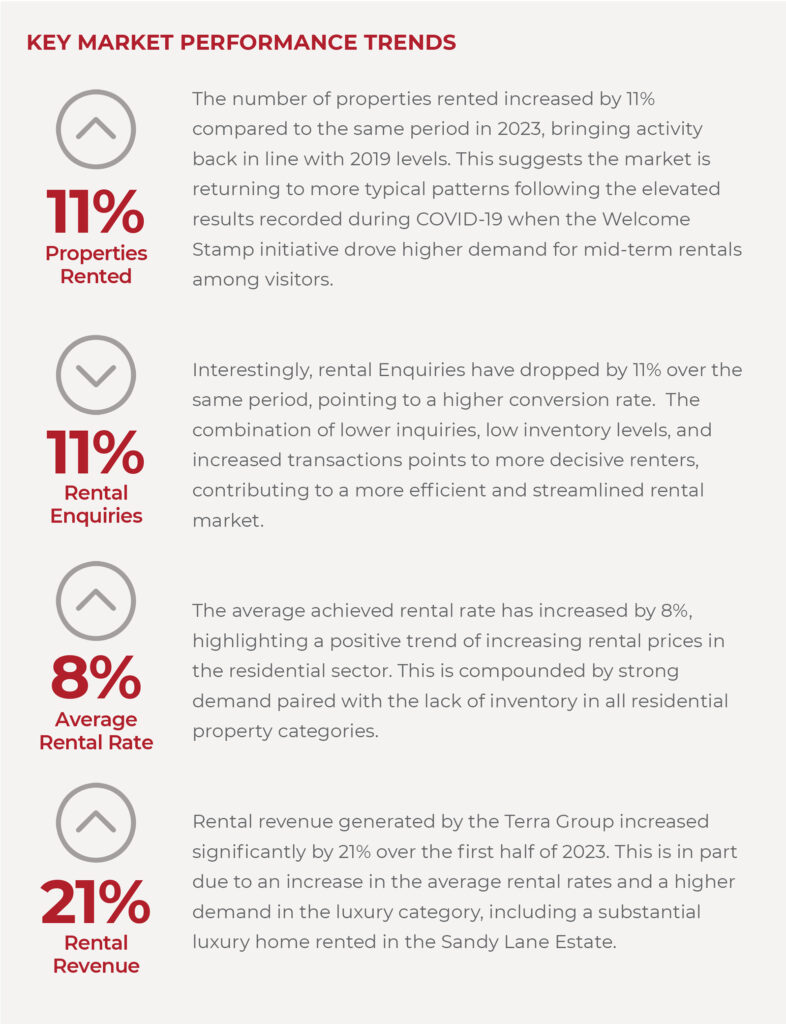

Transactions have increased by 11% when compared to the same period in 2023 and now mirror 2019 levels. The current rental figures reflect a normalization in the market, suggesting that demand has stabilized after the extraordinary conditions experienced during the pandemic. The average rental rate has risen by 8% compared to the same period in 2023, indicating a growing demand and upward pressure on prices.

A review of trends highlights that Gated Communities are the most sought-after, creating a strong demand and generating higher-than-average rental rates when compared to the same period in 2023. Rental revenue from the Terra Group has surged by 21% compared to the same six-month period in 2023 in 2023, highlighting strong performance in the rental market. This is due to a few factors; rental transactions increasing by 11%, increased demand for luxury developments and gated communities, and scarcity of inventory have

Gated Communities are the most sought-after, creating a strong demand and generating higher-than-average rental rates

also been a significant driver of higher prices, creating a competitive environment for available properties. An extremely limited inventory in the luxury rental segment is driving strong demand among prospective tenants, with at least two rentals converting to sales due to scarcity. This trend highlights the difficulty tenants face in securing their desired rental properties.

In the luxury market, properties are primarily rented as short-term or holiday rentals, providing owners with the flexibility to use their homes throughout the year. This arrangement enables property owners to capitalize on peak rental seasons, optimizing their income while enjoying their investments. The current market conditions make it challenging to secure luxury long-term rental homes, and contribute to the limited inventory available.

Real estate agents are actively reaching out to property owners who have listed their homes for sale to explore potential rental opportunities. This strategy has shown some success, particularly with tenants who are open to renting properties that remain on the market for sale.

RESIDENTIAL RENTALS BY NO. OF BEDROOMS

33% rise in the number of 2-bedroom rentals, largely attributed to an influx of corporate and diplomat clients relocating…

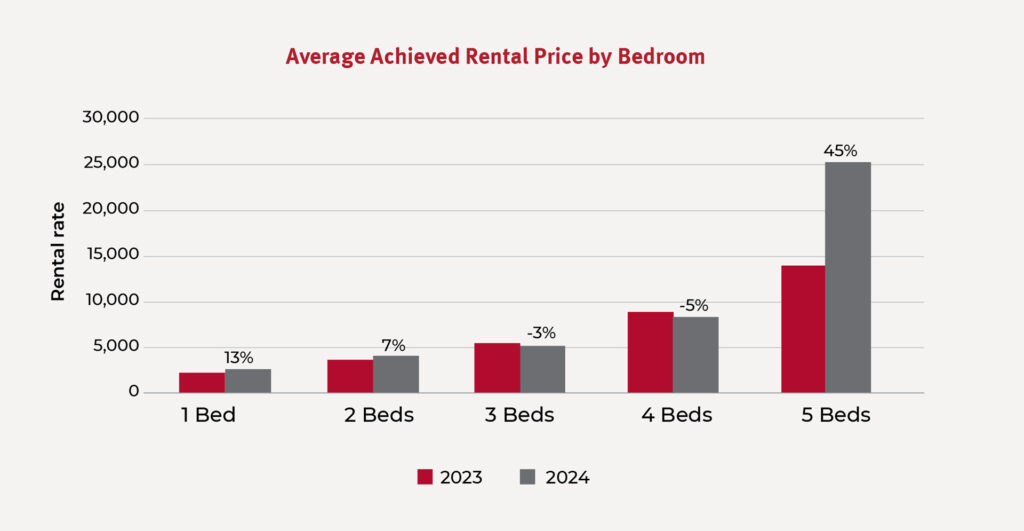

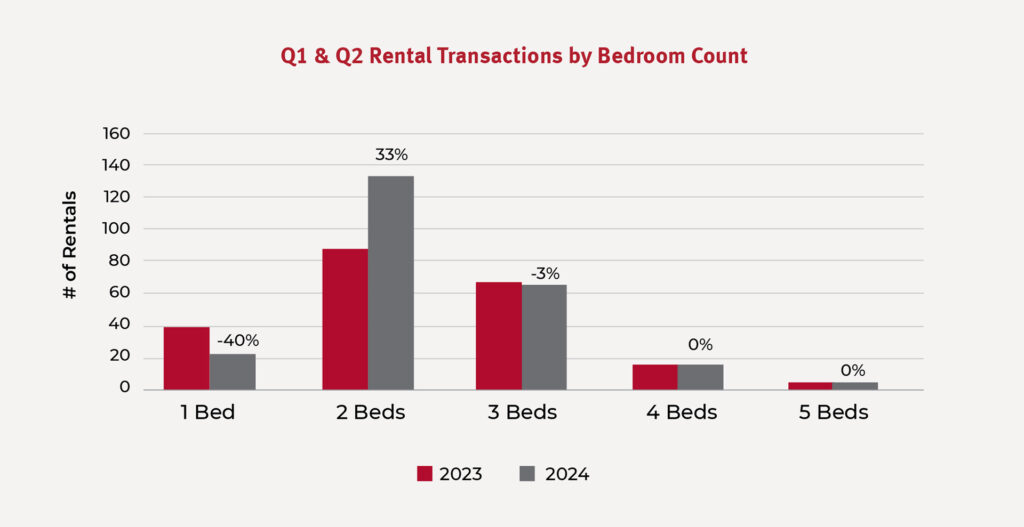

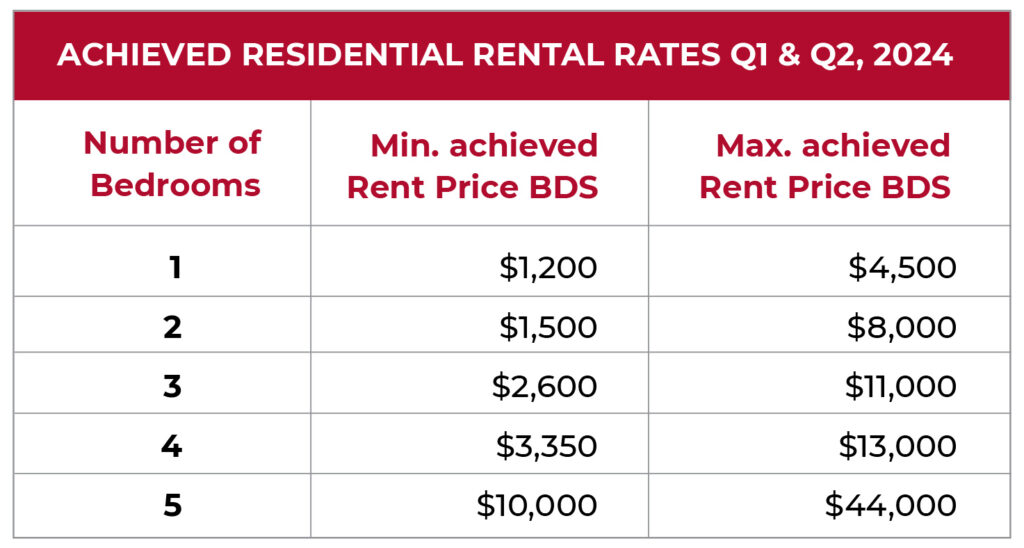

There were 40% fewer 1-bedroom rentals, primarily due to a lack of inventory, when compared to the same period in 2023. Average rental rates for 1-bedroom properties increased by 13%, primarily driven by low supply. Additionally, this lack of 1-bedroom inventory over the first six months of the year has likely contributed to the increased demand for 2-bedroom rentals compared to last year. We’ve observed a 33% rise in the number of 2-bedroom rentals, largely attributed to an influx of corporate and diplomat clients relocating during the first half of the year. This trend reflects a growing demand for this property type. The average rental rate for 2-bedroom properties has increased by 7%. The number of 3 to 5 plus bedrooms rented remained relatively stable compared with last year.

Looking ahead, we anticipate increased interest in family-sized properties with 3+ bedrooms over the summer months, as more families typically choose to relocate during this period. Average rental rates across the 3 and 4-bed categories have remained relatively stable year on year (with plus minus 5% shifts).

The average rate for 5-bedroom properties has seen a significant increase of $11,333, largely driven by a luxury 6-month rental on the west coast, which has raised the average by 45%. This highlights the premium that tenants are willing to pay for mid-term rentals, particularly in high-demand areas on the south and west coastline.

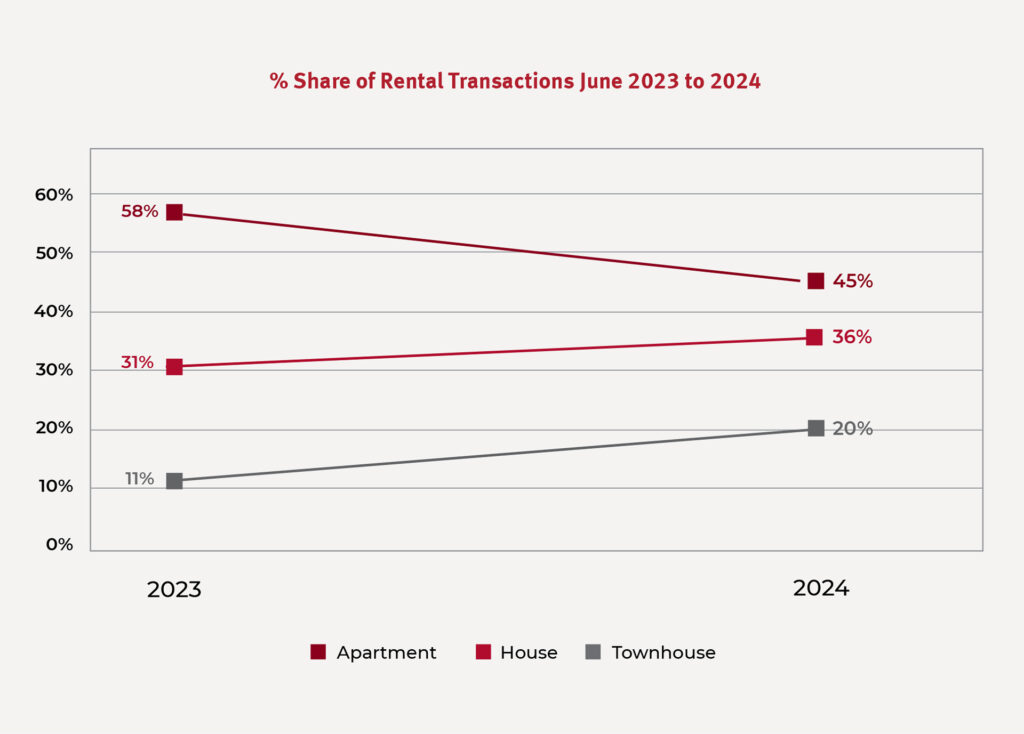

RENTALS BY PROPERTY TYPE

There were significant shifts in the market share by property type, primarily driven by inventory levels per segment. 14% fewer apartments were rented primarily due to a lack of inventory, reducing market share to 45%. The number of homes rented increased by 29%, shifting the market share in this category from 31% to 36%. This has been a notable increase, with 10 more homes rented during this period. Developments like Coverley are particularly sought after. This heightened demand in select communities may influence overall market share trends in the longer term.

The number of townhouses rented has doubled, driving the market share for this property type up by almost double to 20%. This growth is attributed to an increase in available inventory within this category during the first half of the year. New developments like Azzurro and Harmony Hall Green are contributing to this slight inventory boost, providing more options for renters.

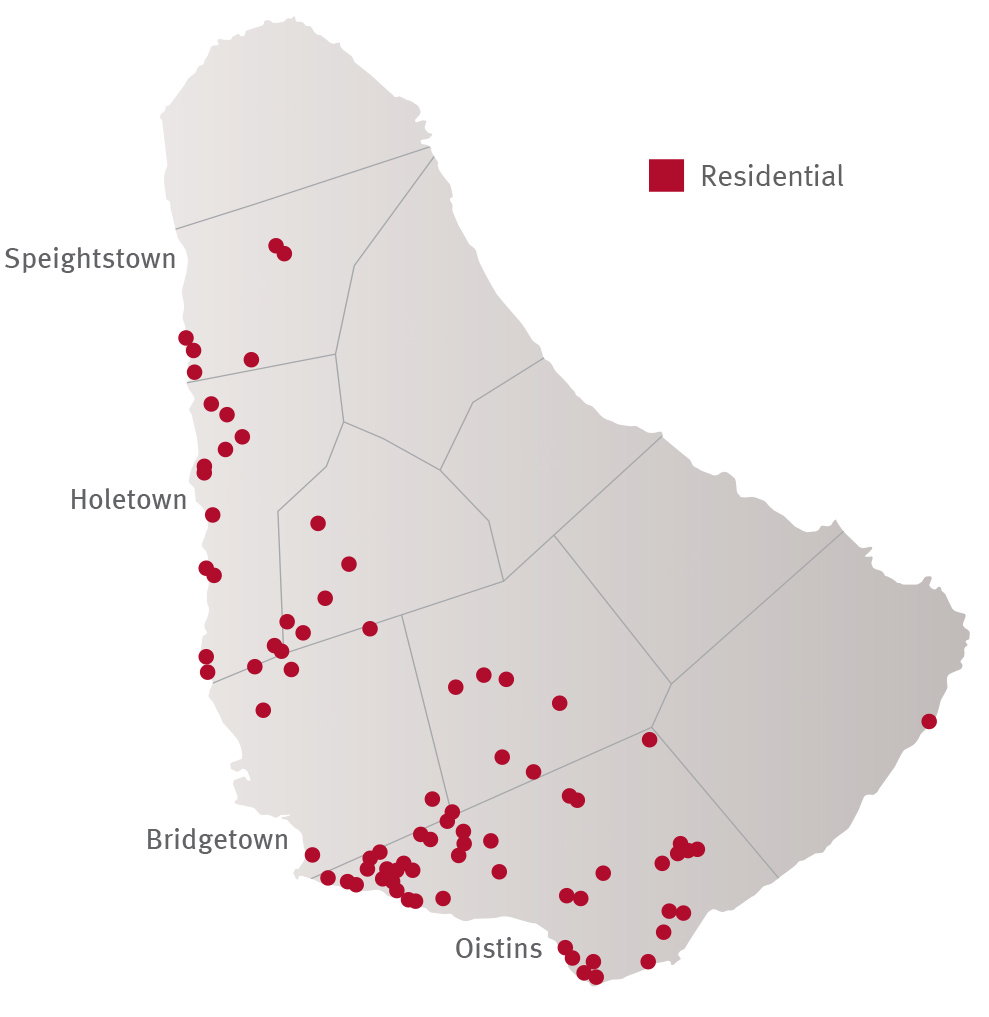

While residential rentals along the South and West Coasts of Barbados remain the most popular, there has been notable interest in more central inland locations during the first half of the year. This diversification in rental preferences suggests that tenants are exploring a broader range of options beyond the traditional coastal areas.

This trend may indicate a shift in lifestyle choices, with some renters seeking more affordable or spacious accommodations in central locations. We have also noted that the recently completed development, The Estates at St. George, has led to an increase in rentals within this central location.

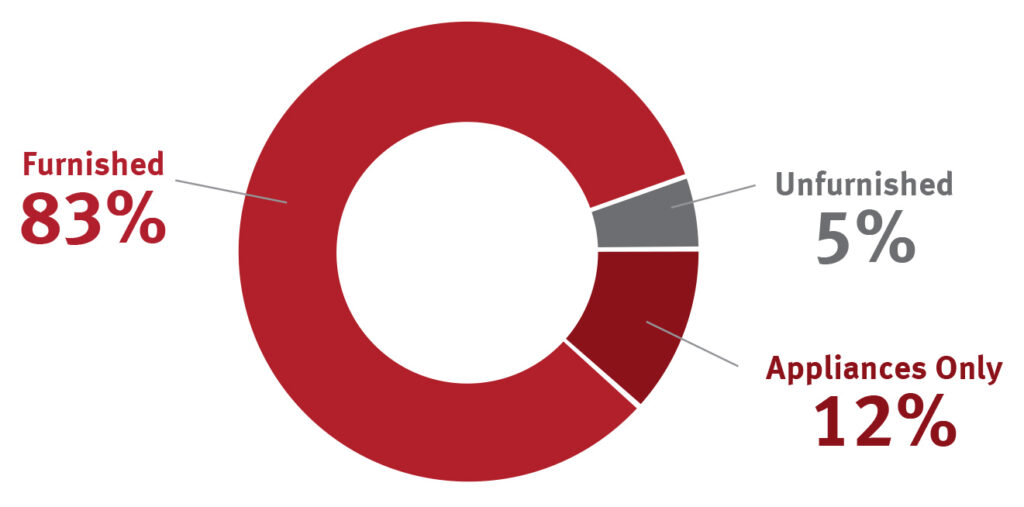

RENTAL PROPERTY SPLIT BY FURNISHED TYPE YTD JUNE 2024

The number of furnished properties rented declined by 10% when compared to the same period in 2023. The decline in furnished rentals has been compounded by lower inventory levels. There were fewer mid-term rentals in the first six months of this year. This decline in mid-term rentals would have contributed to the decrease in the number of furnished rentals as well. Conversely the market share for properties rented with “appliances only” tripled from 4% to 12%.

The rise has resulted from an increase in local rentals and 2 corporate rentals on the higher end. The market share for unfurnished properties remained relatively stable increasing by 1%.

The data in this report is solely from the transactions completed and statistics recorded by Terra Caribbean.

All prices are quoted in Bds$