Property Tax in Trinidad & Tobago: The Facts

The Synopsis

Formerly known as the Land & Building Tax Act, it was surrendered in 2010 after much lobbying and political pressure, resulting in a tax concession up until today. Now renamed “The Property Tax Act”, the current government administration has proposed amendments to the original tax legislation, a new fee schedule, and updated assessment methods. However, plans to reinstate this levy have been halted along the way due to hasty implementation of logistics, court injunctions and public pressure. While we await the proposed Property Tax, here’s what you should know:

What is Property Tax?

Property Tax is a proposed mandatory levy on land payable by the owner.

Who is the owner?

“The owner or occupier of any land, and the receiver, attorney, agent, manager, guardian or committee of any such owner or occupier and any other person in charge or having the control or possession of any land in the right of the owner, or having the possession in his or her own right or as guardian of any person of any such land.” 1

Property Tax is NOT:

- Stamp Duty, a tax that you must pay when carrying out certain transactions that require legal documents.

- A change in ownership to the person paying the tax,

“The liability to tax of the owner of any chattel fixed or affixed to land does not create a legal entitlement to the land upon which the chattel is located where the owner of the chattel is not the legal owner of the land.” 2

- A tax for ancillary structures e.g. fowl coops, kennels or stables

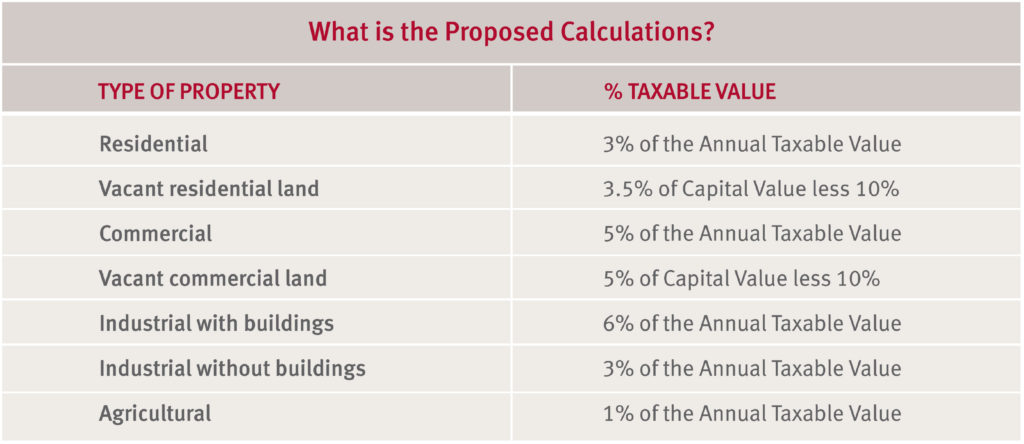

What is the proposed calculation?

The Annual Taxable Value is 90% of the Annual Rental Value of the property.

10% is subtracted from the Annual Rental Value as deductions and allowances in respect of voids (periods when the property may not be rented) and loss of rent (where the landlord is unable to collect the rent).

The Annual Rental Value is determined by the Board of Inland Revenue and is the annual rent which particular property is likely to attract having regard to the purpose for which the land is actually used, occupied or tenanted, or where it is not actually used, occupied or tenanted, having regard to the purpose for which it is reasonably suitable.

Sources:

- PROPERTY TAX ACT CHAPTER 76:04, Act 18 of 2009 Amended by 2 of 2015, pg 7

- AN ACT to amend the Property Tax Act, Chap. 76:04 [Assented to 8th June, 2018], pg 397

The Government plans would be

destructive rendering a harsh blow

on the middle class and lower classes.

These people are already struggling

to survive.

If not checked and balanced

properly the everyday struggles just

to keep up with every other living

expenses and the rising cost of living would lead to great destruction to the social

and political order.

Everything needs to be realistically

balanced and fair to all.

The fundamental problems lies in government handing down harsh and destructive measures to the the

grassroots.

In nature a comparison can be made:

Rich soils are built from a multitude

of lower biological and biomass.

Hence the Big trees cannot say we

“will take from you more than

you have”

“ and we will have no end to taking”

This is morally wrong and a great wrong.

For equality of our existence for all.

Johnnie Raghoo

RGN NMP

BIOCHEMISTRY Bsc. Hons