Buying Property in Trinidad & Tobago

To navigate the intricacies of transacting in this market, our experienced team utilizes in-depth market knowledge to advise you from start to finish of every engagement. Therefore, we have compiled a comprehensive guide to buying and selling property in Trinidad and Tobago.

BUYING PROPERTY

Standard Purchase Procedures

- Written offer and acceptance is needed to start the purchase process. In some cases, consideration is exchanged as an act of good faith

- Sale Agreement is signed by both parties stipulating terms of the sale, either prepared by the chosen attorney or registered real estate professional

- Your 10% deposit goes into escrow at the time of signing Sale Agreement

- Proof of clear title of the property is obtained, conveyance documents and payment of remaining funds are disbursed from your mortgage house to the Vendor, within a 3 to 6 month period (or as stipulated in the Sale Agreement)

Mortgage/Finance

- Financing for up to 80 – 90% of purchase price or valuation price of the property (whichever is less) can be borrowed, and in some cases 100% financing may be available

- Interest rates: Some banks’ mortgage rates are aligned to the MMRR (Mortgage Market Reference Rate) but rates change due to competition on the market. Most banks also have fixed interest rates as well as variable rates based on the mortgage arrangement

- Pre-approved Mortgage Certificate: document which states the amount that you can borrow (the principal sum) based on criteria such as income, age, level of debt and interest rate available

- Amortization term: Amortized monthly payments of principal and interest can be granted for up to 30 years (maximum term and age of client not to exceed government age of retirement). We advise that you ask your bank if there are penalties for early or lump sum repayments

Transaction Costs

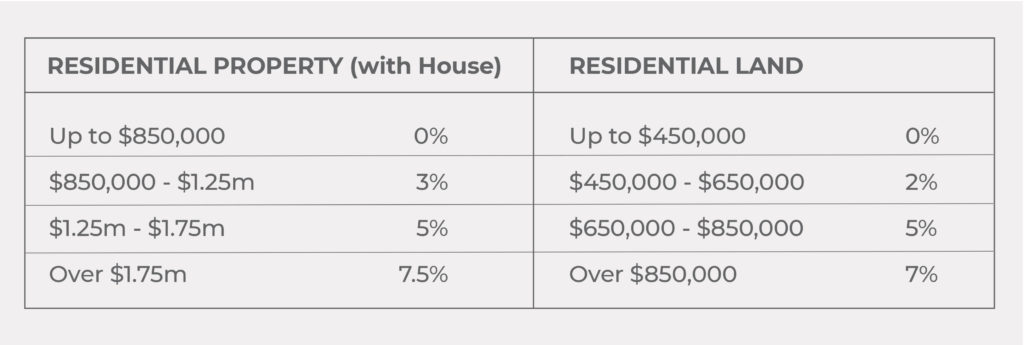

- Stamp Duty

First time homeowners are exempt from Stamp Duty for properties under $1.5m. Properties sold in a company’s name are exempt from Stamp Duty but are subject to a share transfer fee of approximately 0.05% of the value of the shares/ value of the property.

- Attorney fees: approximately 1% – 2.5% plus VAT

- Valuation fees: 0.25% of the determined value of the property plus VAT

- Bank negotiation fees: approximately 1% of the mortgage amount

SELLING PROPERTY

Standard Selling Procedures

- Registered Real Estate Broker is selected

- Written offer and acceptance are necessary to start the process

- Sale Agreement is signed by both parties stipulating terms of the sale, either prepared by the chosen attorney or registered real estate professional

- Provision of copies of prior deeds and cadastral

- All ancillary bills must be paid and up to date

- Conveyance documents are prepared

- Final closing is usually within a 3 to 6 month period (or as stipulated in the Sale Agreement)

Transaction Costs

- Brokerage fees: 3%-5% of sale price

- All utilities to be paid up to date

These bills must be paid, up to date and documents signed

Documents that must be submitted before change of ownership:

- WASA Clearance

- Land & Building Tax Receipts

- Home Owner’s Association consent to assign

- Home Owners’ Associations fees (where applicable)

- Regional certificates, Certificates of Completion or Consent of Lessor where the property resides on leasehold land

If someone is selling a rented property and wishes to sell it, does the present tenant have to be given first priority to buy?