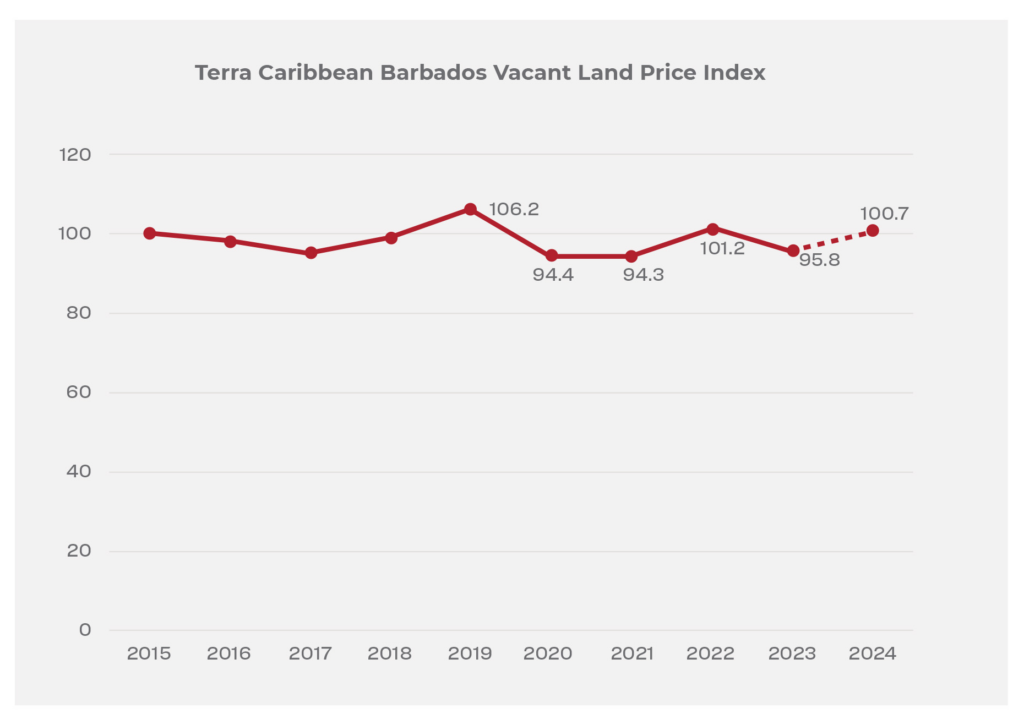

Terra Caribbean Barbados Land Price Index 2024

This index uses the median price per square foot of vacant land sales in Barbados to track the

shift in price trends over time from the base year of 2015. This includes residential, commercial,

and agricultural land. Median values are used for indices as these resist the influence of outliers

in our relatively small datasets. The median is less sensitive to outliers compared to the average.

A single outlier can significantly impact the average, pulling it away from the central tendency

of the data. On the other hand, the median is less affected by such extreme values since it only

considers the middle value.

Based on 2023 data, the index declined to 95.8 or 4.2% below the benchmark year of 2015. The

data for 2024 up to June indicates a slight increase to 100.7 which is an encouraging sign if this

can be maintained for the rest of the year.

Fig 1. Terra Caribbean Barbados Vacant Land Price Index 2024 (Partial)

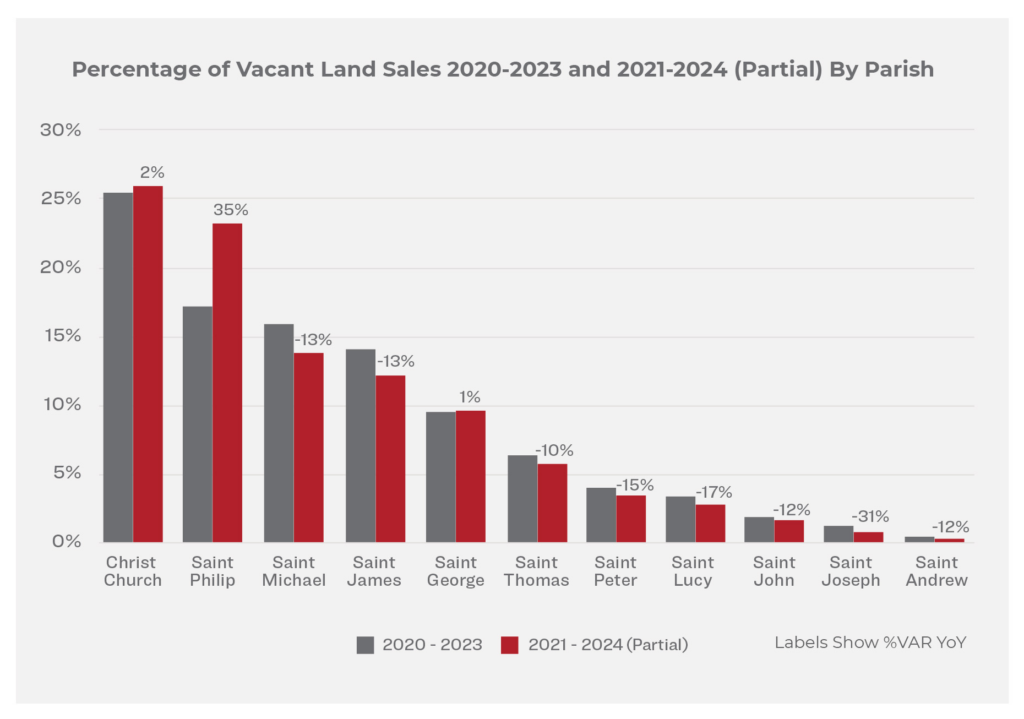

SALES BY PARISH

Our parish methodology differs from the overall index as when we drill down to parish level the parishes with smaller volumes can often have little to no activity. To minimize the effect of this we use a rolling period of three complete years plus the first half of the current year. This means that unlike the overall index the data set shifts over time which dynamically affects the median values as older data drops out and newer data is added.

PERCENTAGE OF SALES BY PARISH

One of the defining features of the market for vacant land is the importance of land-only developments. In previous years we have noted these as the key driver of the volume of sales in the top parishes. This trend continues but of import, during the second half of 2023 and first half of 2024, sales in St. Philip increased significantly from 17% in the last index to 23%, this six percent growth represents a 35% Year on Year change in the proportion of transactions for the parish.

Fig 2. Percentage of Vacant Land Sales 2020-2023 and 2021-2024 (partial) By Parish

Sales in development in the districts of Sandy Hill, Gemswick, and Vineyard accounted for ~45% of the vacant land sales in St. Philip for the period July 2023 to June 2024. St. Philip has also seen increasing commercial development which has further positively impacted residential development activity.

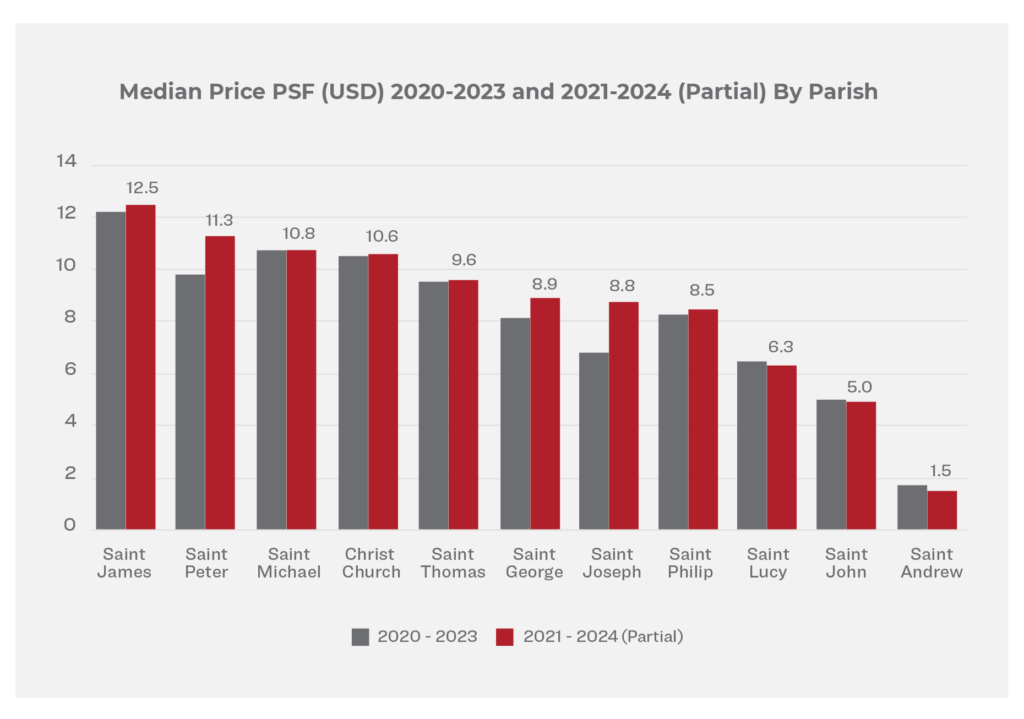

MEDIAN PRICE PER SQUARE FOOT (USD) BY PARISH

St. James continues to hold the top spot in the ranking for parish median price and is slightly

higher this year compared to the prior period. Several parishes saw notable increases with

St. Peter, St. George, and St. Joseph all showing increases as key sales in high-value areas in these

parishes have had an effect. These areas include Gibbes in St. Peter, Rowans in St. George, and

Cattlewash and Bathsheba in St. Joseph. Fig 3 below shows the median price for the current

period by parish and the 2020-2023 period also.

Fig 3. Median Price PSF 2020-2023 and 2021-2024 (partial) By Parish

The activity in Cattlewash and Bathsheba is notable as they are very different from traditional transactions in those parishes. Residential builds in these areas have traditionally been modest “beach houses” for local families but this year we have seen several projects more in line with the type of house normally associated with the west coast. These high-value outliers and the traditionally low volumes in the areas have had an impact on the median prices in these area The impact is smaller than if we were using the average price as our metric but still notable.

ONE TREND WORTH NOTING

St. Philip continues to show strong potential for growth as evidenced by the strong growth in the volume of transactions and the number of residential developments that account for a large percentage of sales, demand for the parish as a place to live. This growth in residential options goes hand in hand with commercial opportunities as can seen in the recent developments in Six Roads. I would expect that as the six roads area reaches capacity commercial development is likely to spread to areas near the established commercial hub.

Notably foreign buyers have driven increased interest on the east and with traditionally low volumes in these areas, the high-value outliers have less of an impact when measuring the median, significant changes in outliers can still affect the position of the median if they alter the overall data distribution.