Terra Caribbean Market Report Sales Q1 & Q2 June 2024 – Barbados

SUMMARY

In the first half of 2024, Terra Caribbean experienced significant growth, with a 75% increase in the number of properties sold compared to the same period in 2023. The average price of properties sold rose by 25%, reaching its second highest level in the past five years. Sales activity increased across all price ranges, indicating a robust and healthy market.

Notably, the average discount between listed and agreed sale prices narrowed by 1.3% to 3.3%, the lowest in five years, signaling a more competitive market. While new sale inquiries remained steady, the conversion rates improved, contributing to Terra Caribbean’s fourth consecutive financial year of record sales.

Additionally, pending sales saw a 39% year-on-year increase, suggesting a strong performance for the remainder of 2024.

THE DETAIL

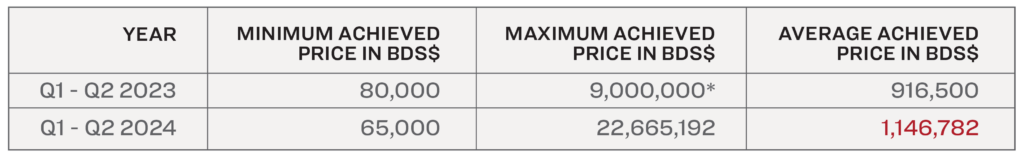

OVERALL AVERAGE SALE PRICES

75% More

Properties Sold

25% Increase

in average sale price

- The number of properties sold during the first 6 months of the year, which includes our traditional high season, has increased annually since 2000.

- The average price of properties sold over the period increased by 25% and is at the second highest level in 5 years.

- Terra Caribbean sold 75% more properties in the first 6 months of 2024 when compared to 2023.

*The maximum sales value reported in 2023 does not account for the sale of a flagship property which took place over that period.

TRANSACTIONS BY PRICE RANGE & PARISH

- The number of properties sold increased across all of the above price ranges.

- The market for properties priced below $1M is robust, accounting for 79% of the properties sold in the 1st half of 2024.

- There was a 22% increase in the number of properties sold under $500,000 in the first half of 2024.

- This was driven by sales at popular projects including Coverley, Atlantic Breeze and Carmichael Crescent.

- There was a marked increase of 166% in the number of properties sold between $500,000 and $1 million.

- This increase was driven by the completion and handover of apartments at The Estates development in St. George & Coral Beach in St. Peter.

- The $1M to $1.5M range experienced a significant rise, with three times as many properties sold compared to the previous year. Three times as many properties were also sold in the $2M to $5M range.

- The number of properties sold in the other luxury categories increased by between 17% and 29%.

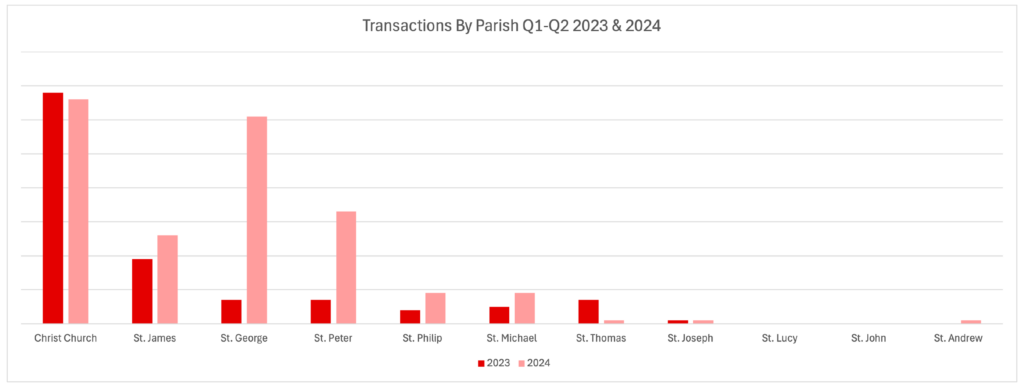

TRANSACTIONS BY PARISH

- Christ Church remains the most popular parish, accounting for 32% of sales transactions in the first half of 2024.

- Average prices increased in Christ Church by an impressive 58%.

- Closely followed by St. George whose numbers have been extraordinarily inflated by the bulk closing of apartment sales at The Estates.

- St. Peter reported the second highest jump in property sales with strong interest in Gibbs, Mullins, Vuemont and the recently completed Coral Beach development.

- St. James, traditionally the second most popular parish, recorded 37% more properties sold but dropped to 4th in the number of properties sold.

- St. James also saw the second highest increase in average sales price, up 43% from 2023.

- Interest in the other parishes showed mixed trends with St. Philip and St. Michael being the more popular.

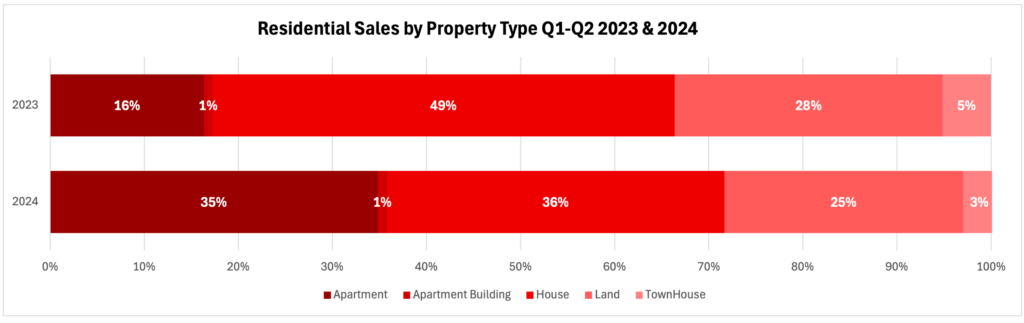

RESIDENTIAL SALES BY PROPERTY TYPE

- Apartment sales surged by 268% in the first half of 2024, capturing a 35% market share. The Estates accounted for 67% of these sales.

- There was 1 apartment building sold in the first half of both 2023 and 2024.

- Houses remained in high demand with 26% more homes sold over 2024 six month period, representing 36% of the market share.

- Land lot sales reached their highest level in the past five years, driven by strong interest in Carmichael Crescent, which offers attractively priced lots starting at $85,000.

- While the number of Townhouses sold increased slightly by 1 the market share decreased to 3%.

- It is worth noting however that several new townhouse developments have recently been launched and demand in this segment has been high, with some projects now “fully pre-sold” suggesting that market share will increase.

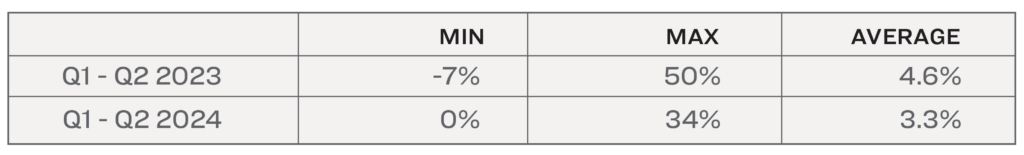

AGREED SALE PRICE DISCOUNT FROM LIST PRICE

- Average discount levels between Listed Sale Prices and the Agreed Sale Price reduced by 1.3% to 3.3% and are within their lowest level for the last 5 years.

- 36% of properties were sold at a discount of between 1% and 10% from the Listed Sale Price.

- The significantly discounted sale prices agreed over the past 6 months were realised for a small selection of forced sale properties, or properties which were priced above market.

- An impressive 50% of sales achieved over the period were agreed at the Listed Sale Price.

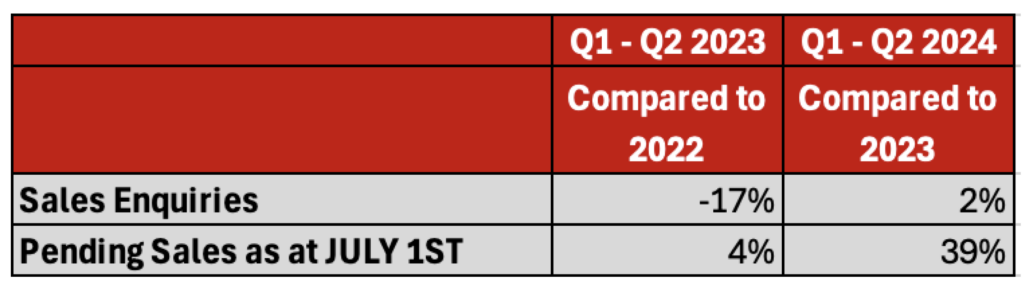

LEAD INDICATOR TRENDS – SALES ENQUIRIES & PENDING SALES

- The number of new sale enquiries recorded by Terra Caribbean over the first 6 months of the year remained steady.

- It is noteworthy that FY 2024 ended on the fourth consecutive year of record sales levels indicating that conversion rates have strengthened.

- Pending sales** has increased by an impressive 39% over the same date last year which is a positive lead indicator for the next 6 months suggesting 2024 will close out on a positive note.

- Numerous sales have been agreed at new developments like Allure in Brighton, Sugar Apple at The Villages at Coverley, and Atlantic Rising in Christ Church, Valley View and Carmichael Crescent resulting from high demand. These sales are expected to close in the second half of 2024.

** Pending sales measures the value of sales agreed and awaiting settlement as at July 1st.

The data in this report is solely from the transactions completed and statistics recorded by Terra Caribbean. All prices are quoted in BDS$.