Comparative Analysis of Sales in Grenada 2018 – 2020

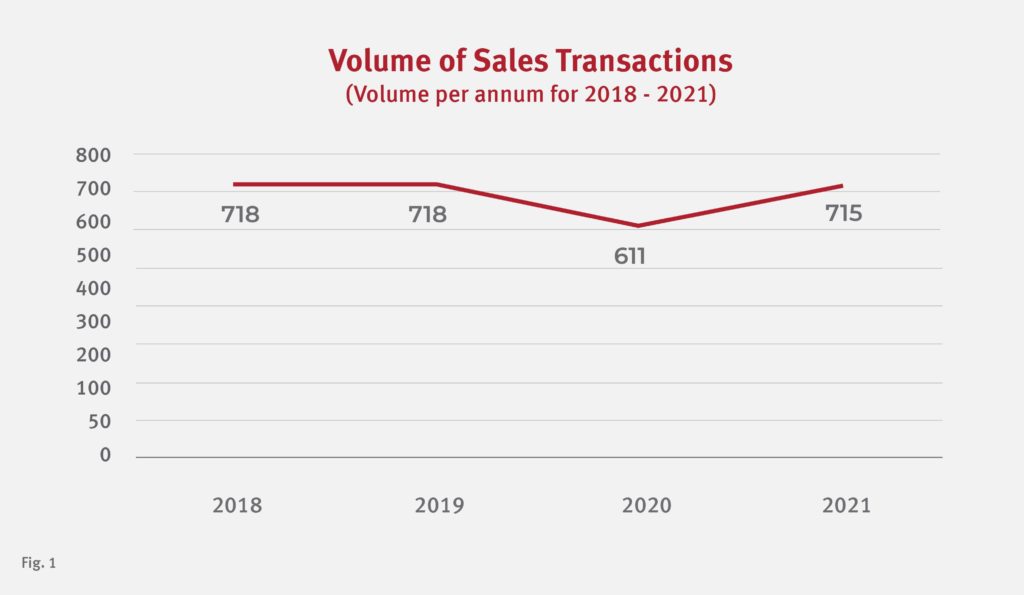

In the comparative analysis, 2 years (2018 and 2019) which are pre-COVID-19 and 2 years (2020 and 2021) throughout COVID-19, were reviewed to see the impact of the pandemic on the real estate sales market. As depicted in figure 1, the volume of sales was constant from 2018 to 2019 at 718 sales each year; however, in 2020 there was a decrease of 15% in the total volume of sales. In 2021 the volume of sales returned to pre-COVID-19 numbers at 715 sales.

See Figure 1 below

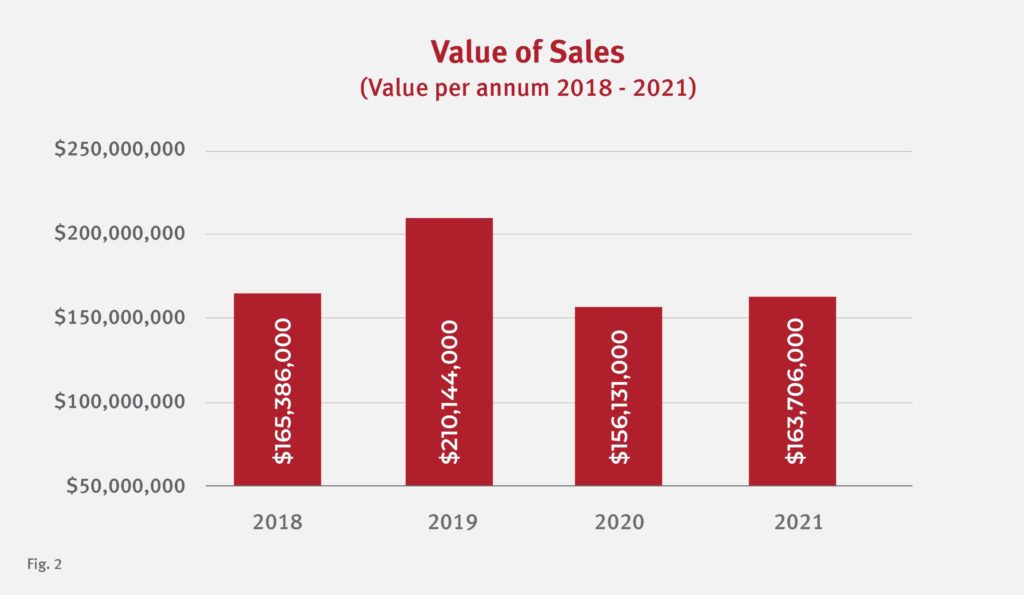

The total value of sales comparison had more variations: 2019 increased by 27% from 2018; however, in 2020 sale value decreased by 26% when compared to 2019. In 2021 the total value of sales had increase of 5% when compared 2020.

See Figure 2 below

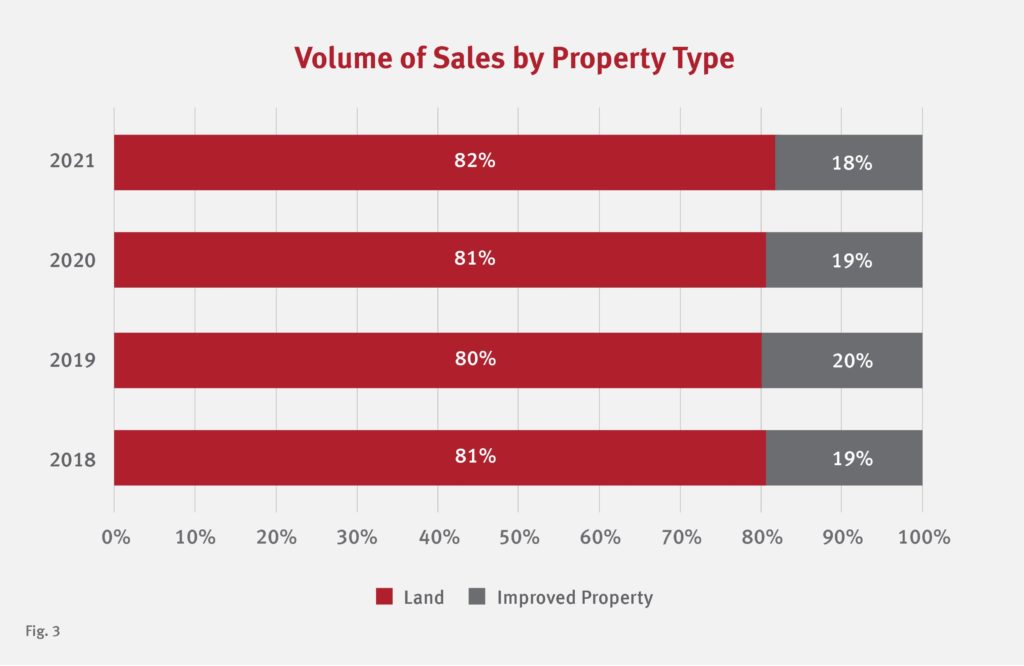

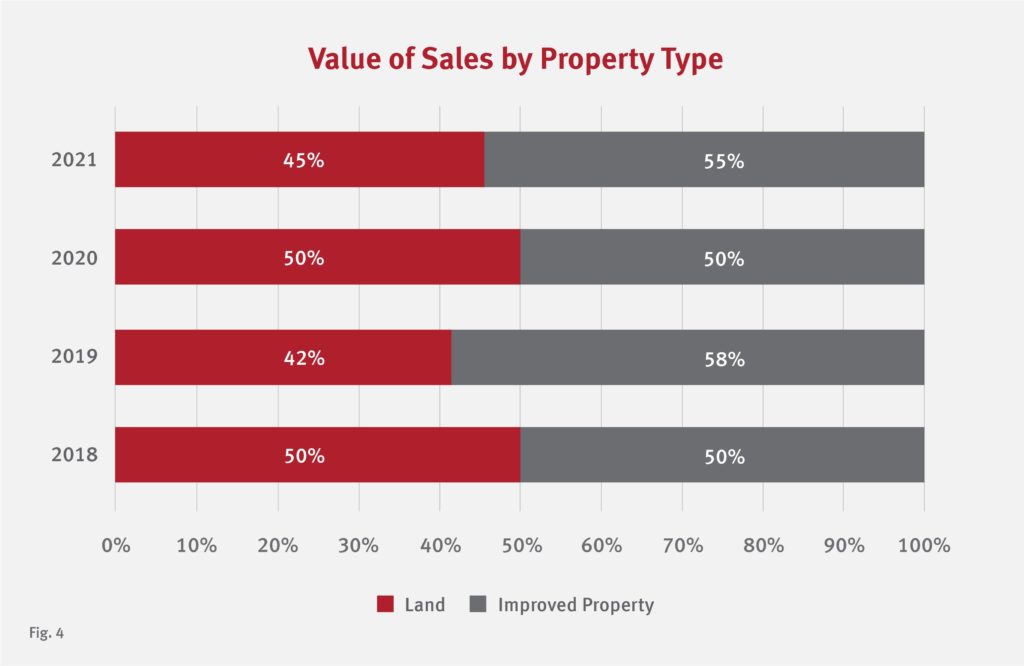

The trend for sale transactions by volume by property type is very similar throughout the years, with land sales dominating improved property sales; however, as it relates to sales transactions by value, improved property sales are usually equal to or marginally greater than the value of land sales.

See Figure 3 & 4 below

It should be noted that the data compared above only included regular sales; however, the impact of other sales (outliers) is significant and should not be overlooked. In 2018, the outlier value of sales was EC$ 1,972,000 with a contributing percentage of 1% for that year. In 2019, the outlier value of sales was EC$ 150,009,000 with a contributing percentage of 42% for that year. In 2020, the outlier value of sales was EC$ $116,612,000 with a contributing percentage of 43% for that year. And in 2021, the outlier value of sales was EC $67,877,000 with a contributing percentage of 29% for that year.

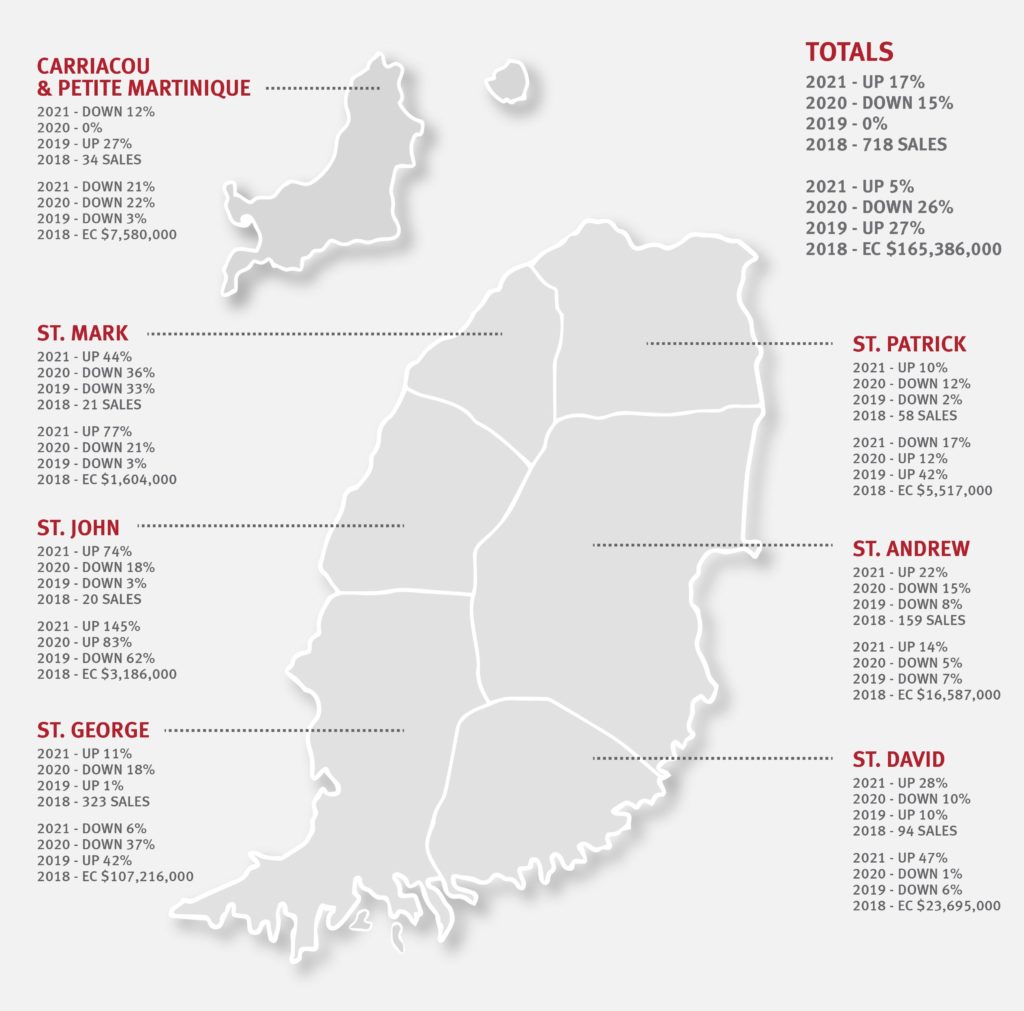

Figure 5 shows a comparative analysis of each parish by volume and value of sales from 2018 to 2021, and a total analysis of each year.

See Figure 5 below

*All values noted are in EC Dollars and rounded to the nearest thousand

Conclusion

This analysis was an overview of the real estate market for 2021 & 2020, and comparison to previous years. It should be noted that the pandemic delayed the speed of transactions completion; as per the data analysed and presented, there were decreases in the volume and value of sales for the period 2020 and 2021. It must be noted that despite the decreases in comparison to pre-COVID-19 years, they performed better than previously expected. Furthermore, analysis for 2021 indicated a positive trend when compared to 2020. We have also noted the significant impact of Citizenship by Investment (CBI) transactions and large development investments by foreign investments to the real estate market. The analysis provides insights on the real estate market to assist buyers, investors, financial institutions, market participants in making informed decisions.